Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | November 20, 2025

Jeffrey Gundlach is ringing the alarm bell, and if you squint hard enough, you can see the smoke rising from the edges of this market.

In his latest interview, the bond king joins a growing chorus...including Jamie Dimon and, yes, even Warren Buffett...of elite investors quietly repositioning themselves for what could be a major market unraveling.

Let’s walk through why Gundlach is now urging investors to hold 20% in cash, what the implosion of private credit could mean for the broader economy, and how anecdotal signs from companies like Target are starting to paint a picture of systemic weakness.

And as we move through each warning sign, a pattern starts to emerge...one that suggests the real story isn’t just about cash levels or cautious CEOs, but the unseen leverage tying all of these signals together.

20% in Cash: Gundlach and Buffett’s Unlikely Alignment

Jeff Gundlach’s advice is simple but striking: keep 20% of your portfolio in cash.

It’s not the kind of bold, risk-on move you’d expect in a bull market. But that’s exactly the point...Gundlach doesn’t believe this is a healthy market.

Warren Buffett, often thought of as the eternal optimist, is doing the same. He’s now holding a record level of cash and has refused to buy back his own stock, even as Berkshire Hathaway shares have dipped.

Buffett would rather earn a yield on Treasury bills than bet on his own company’s future cash flows. That alone should make you pause.

And history supports this strategy. Buffett hoarded cash in 1999 and 2006, just before the dot-com bust and the Global Financial Crisis. Is he sounding the same silent alarm now?

If the legends are stepping aside, the question becomes: what are they stepping aside from? To answer that, we have to follow the money into the one sector where bullish narratives and reality have violently diverged.

The AI Bubble: What If There’s No There There?

Gundlach isn’t just worried about broad market valuations...he’s specifically calling out AI-related stocks and data center investments as areas of speculative excess.

Sound familiar? It should. The parallels to 1999 are uncanny: huge CAPEX spending, vague profit projections, and endless hype.

The tech titans today are pouring billions into data centers, assuming endless future demand from AI. But where is the revenue? OpenAI claims $12 billion, but what are the expenses? Hundreds of billions? The profit margins don’t justify the valuation.

As George put it, this becomes a classic case of “show me the money.”

AI may be transformative, but the economics still matter. Otherwise, it’s just another tulip craze with GPUs.

And just like the dot-com era, the danger isn’t only in the overhyped assets themselves…it’s in the quiet, opaque structures that financed them. Which brings us to the real powder keg.

Private Credit: The Next Subprime?

The real warning, though, comes from Gundlach’s focus on private credit.

He compares today’s froth in private lending to the subprime mortgage market in 2006. It’s not just hyperbole.

Funds like Blue Owl are now being forced to cancel planned mergers and limit redemptions because of investor panic.

Blue Owl’s plan to merge two private credit funds through an IPO came with a nasty surprise: investors would be locked out from withdrawing their money until the deal closed...potentially years from now.

The market’s response? A hard “no.” Blue Owl’s stock tanked. The writing’s on the wall.

This is the same story we saw with mortgage-backed securities pre-2008: take illiquid, risky assets, package them up, and promise easy redemption.

That contradiction doesn’t work. When redemptions spike and no one wants to buy the assets, the whole thing implodes.

Gundlach sees it clearly: “The next big crisis in financial markets is going to be private credit.”

And if private credit is today’s subprime, then we should see confirmation in the plumbing of the system itself...where stress shows up long before the headlines.

The Hidden Perils Lurking in Private Credit

Imagine waking up to headlines screaming about massive tremors in the financial markets…Jefferies under scrutiny, private equity funds teetering on the edge, regional banks sweating bullets, and even the giants of Wall Street and European shores feeling the heat.

The Repo Market Is Whispering, Too

Want more proof something’s wrong under the surface? Look at the repo market.

Secured loans (backed by collateral) are trading at higher rates than unsecured interbank loans.

That makes no sense unless liquidity is drying up or counterparties don’t trust each other. The Fed’s Standing Repo Facility is being tapped more frequently...another red flag.

This isn’t just a technical blip. It’s a signal of stress, especially when viewed alongside what’s happening in shadow banking, private credit, and collateral rehypothecation.

And when financial plumbing clogs, it doesn’t take long for the effects to spill into the real world...often first appearing where nobody wants to believe they matter.

Target: Ghost Towns and Corporate Spin

Now, let’s connect this financial market dysfunction to the real economy.

Target, the quintessential middle-class bellwether, just posted declining sales and slashed its forward guidance.

George saw it firsthand in New Orleans: empty stores, empty aisles, and no employees in sight.

And yet, their PR spin is peak clown world:

“We’re excited to announce a new partnership with OpenAI.”

Because nothing says “we’re totally screwed” like adding a chatbot to your customer service line.

Target’s earnings decline isn’t about bad strategy. It’s about the 75% of Americans who are living in what feels like a recession. They’re trading down, buying less, and hunting for deals. This is a K-shaped economy at its breaking point.

If AI hype deflates and asset prices correct, that top 25% also takes a hit. Then the whole system starts to wobble.

But the wobble isn’t just about who’s spending...it’s about what happens when both ends of the economy begin falling at the same time.

The h-Shaped Economy: When Everyone Gets Hit

George introduced a brilliant new metaphor: the h-shaped economy.

In a K-shaped recovery, the rich get richer while the poor fall further behind. But what happens if asset prices fall?

Suddenly, both legs of the “K” bend downward, forming a sharp drop for everyone. That’s the h-shape.

We’re seeing the first hints of this in:

• Layoffs in tech and media.

• Weak retail numbers from Target, CarMax, and others.

• Softening home prices despite low inventory.

If the top starts falling, there’s no one left to keep propping up GDP.

And the final ingredient in this toxic recipe? A narrative so inflated that when it finally pops, it drags everything else down with it.

The AI Fallacy: 65% of Global GDP?

Let’s not forget NVIDIA CEO Jensen Huang’s mind-bending claim: that AI’s revenue potential is 65% of global GDP, because it can replace human labor.

This is corporate fantasy land. Even if AI replaces half of labor, that doesn’t mean companies will pay AI companies 65% of GDP. The whole point of replacing labor is to cut costs, not create new expenses. Profit margins don’t expand infinitely...they compress as competition drives prices down.

AI will be transformative, yes. But many of these “hyperscaler” business models simply don’t add up.

And when the math stops adding up at the same moment liquidity gets tight and consumers pull back, the next phase becomes less about predictions...and more about survival.

What To Watch For

More Private Credit Blowups: Look for more funds halting redemptions or restructuring.

Retail Weakness: Pay attention to bellwether stocks like Target, Chipotle, and CarMax.

Liquidity Signals: Repo rates and Fed interventions are your smoke detectors.

Tech Hype Peaks: Valuation sanity checks on Nvidia, OpenAI, and others.

Buffett and Gundlach: When the smartest money is hoarding cash, you should ask why.

And the question now isn’t whether these signals matter...it’s what happens when they start converging.

When Smart Money Gets Nervous, You Should Too

This isn’t about fearmongering. It’s about reading the signs:

• The Fed is still dealing with illiquidity.

• Private credit is showing stress fractures.

• Consumers are tapped out.

• Tech valuations are beyond frothy.

Jeff Gundlach, Jamie Dimon, and Warren Buffett are all singing variations of the same tune: Something is not right.

The average investor would be wise to listen.

If you’re relying on the mainstream media to spot the next crisis, you’re already behind.

Every day, we break down these signals before they hit the headlines. Because for Rebel Capitalists, information isn’t entertainment...it’s survival.

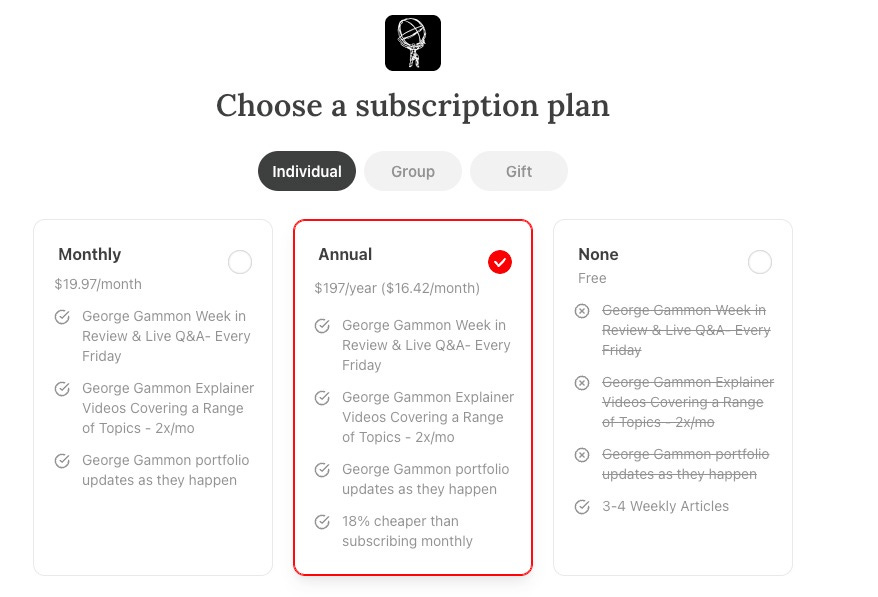

If you want:

• Early warnings before the next credit shock.

• Real analysis of layoffs, liquidity stress, and policy mistakes.

• A community of investors who don’t buy the official narrative.

Then it’s time to upgrade and get the full Rebel Capitalist News Desk experience.

👉 Become a premium subscriber here:

Stay ahead of the herd.

Stay awake.

Stay free.