When Hot Chicks Hit Eviction Court

Why Ridiculous Indicators Might Be the Smartest Ones

Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | September 23, 2025

Most investors obsess over the Fed. Or CPI. Or whether Powell wears a red or blue tie at FOMC meetings.

But what if I told you the real signals…the ones with teeth…are hiding in plain sight? Or in some cases, hiding in the absurd?

Welcome to the world of weird but wildly effective economic indicators.

This week, we’re diving into subprime auto meltdowns, collapsing homebuilder margins, and…yes …hot chicks getting evicted. No joke.

These anecdotes might be some of the best asymmetric indicators out there.

First, A Quick Reality Check

Let’s zoom out.

Yes, the stock market is up. The S&P is printing green candles. But that doesn't mean the economy is healthy.

In fact, the economy is flashing warning signs…again:

Leading Economic Index down.

Construction jobs softening.

Mortgage apps spiking (a late-cycle trap).

Consumer confidence sinking.

Subprime debt blowing up.

And in that context, these “ridiculous” indicators aren’t so ridiculous after all. They’re telling you something Wall Street refuses to hear.

The mainstream insists these are just “soft spots”…but when you piece the puzzle together, the picture changes fast. And once you see the housing data, the illusion of stability falls apart.

Lennar Homebuilders: The Real Housing Indicator

Forget Zillow. If you want a real read on housing, look at Lennar (LEN).

The stock is down 11% YTD, but the last five days have been brutal…all because of a single earnings report. They missed expectations and blamed margin compression.

Here’s the kicker: they’re not lowering home prices directly. Instead, they’re playing a game of smoke and mirrors.

Builders offer buyers massive interest rate “buy-downs” or $50,000 credits…so they can avoid reducing the sticker price and impacting neighborhood comps.

But make no mistake…these are real price cuts.

And they show up in the margins.

Why does this matter? Because when LEN can no longer stomach those margin hits, they'll have to drop prices for real…and comps will collapse.

Once comps collapse, the illusion of home equity disappears. Which brings us to a nasty feedback loop:

Comps fall.

Homeowners feel poorer.

Consumer spending declines.

Economy contracts.

Forced sales increase.

Prices fall further.

Sound familiar? It should. This is the prelude to every housing-led downturn in modern U.S. history.

What happens when comps collapse and homeowners realize their paper wealth was an illusion?

The next shoe to drop isn’t just prices…it’s confidence.

And when confidence evaporates, even the so-called “untouchable” parts of society feel the pinch.

The “Hot Chick Eviction” Indicator

Okay, let’s talk about the most controversial…and maybe most brilliant…economic signal in years.

A real estate lawyer in LA recently quipped on social media:

“There are almost never attractive women in eviction court. Seen two this week. Major recession indicator.”

Crude? Maybe. But also… spot on.

Let’s break this down in economic terms:

Attractive women often have non-monetary social safety nets…i.e., thirsty beta orbiters.

If even they are being evicted, it means both their personal finances and their extended "simp-net" are tapped out.

That implies a broader credit and liquidity crunch…not just for them, but for the economy at large.

If the perceived most insulated segment is getting hit, you know the damage is deep.

You can laugh at the surface-level ridiculousness…but you ignore the signal at your own peril.

If the outer layers of the social safety net are failing, what’s happening beneath the surface?

The answer is even darker…because desperation doesn’t just show up in eviction courts. It shows up in crime, fraud, and fire.

Boat Fires: Arson as Economic Signal

Let’s talk insurance fraud.

An ex-insurance adjuster dropped this gem:

“The best early recession indicator is boat fires.”

Why?

Boats are luxury items, often bought on credit.

They depreciate like crazy.

And they're fully insured.

So when cash gets tight, guess what happens? The boat just happens to mysteriously catch fire. Insurance covers it. Debt vanishes. Crisis averted…sort of.

This is the dark side of consumer stress. Not just tighter spending…but outright desperation.

And guess what? Insurance claims for boat fires are spiking.

Forget the VIX. Boat fires are your new leading indicator.

When people start torching luxury assets to survive, you know we’ve crossed a line.

But this isn’t confined to the wealthy weekend boat owner. The same stress is boiling over in America’s most fragile credit markets.

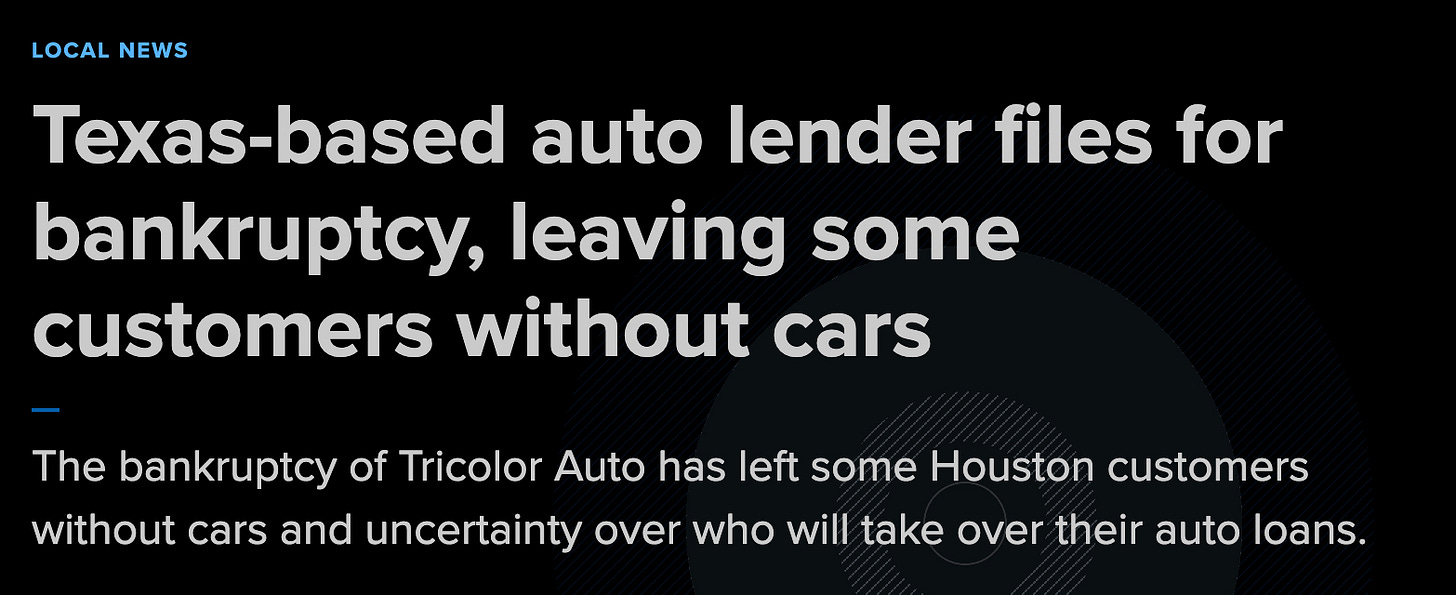

The Subprime Auto Meltdown: The Bubble No One’s Watching

Tricolor Auto, a subprime lender catering largely to undocumented borrowers, just collapsed. Not a restructuring. Not Chapter 11. Chapter 7 liquidation.

Their ABS (asset-backed securities) went from trading above par to 12 cents on the dollar…in just a few months. A triple-A rated tranche issued this summer is now marked to 78 cents.

That’s not a drawdown. That’s a blow-up.

And it’s not just about undocumented borrowers. The entire subprime auto market is cracking because:

People are stretched thin.

Car prices were inflated.

Loan durations were extended to 84+ months.

Most borrowers are now underwater.

Worse, the people buying these loans…pension funds, insurance companies…had to take the risk. With Treasury yields below their return targets, they were forced out the curve.

Now the bill is coming due. And the systemic risk is real.

When a AAA-rated tranche gets obliterated in months, it’s not just an isolated failure.

It’s a crack in the foundation. And if you think the fallout ends in autos, wait until you see where “easy money” really went missing.

The Illusion of “Easy Money”

There’s a dangerous myth floating around: the idea that money is “easy.”

It’s not.

For small businesses? For average consumers? For mid-size entrepreneurs?

Money is tight. Banks aren’t lending unless you're a massive corporate zombie that they know will get bailed out.

George Gammon has said it before: rates don’t determine the economy…they reflect it. Low rates often signal tight conditions, not loose ones.

And while corporate spreads may look tight, that may just reflect forced buying by yield-starved institutions who have no choice.

Money feels abundant to policymakers and corporate zombies, but the real economy is starved.

And once you peel back that curtain, the truth is unavoidable: we’re already in a recession…even if the official scorekeepers won’t say it.

The Real Economy Is in a Recession…Whether NBER Admits It or Not

Ignore the NBER’s definition. Look around.

Consumer delinquencies are up.

Car repossessions are near 2009 levels.

Construction is stalling.

Homebuilders are hiding losses.

Evictions are rising.

Subprime lenders are folding.

Weird anecdotal indicators are going parabolic.

Is that a recession? You tell me.

The anecdotes line up with the hard data. You don’t need a PhD economist to see what’s coming…you just need to be willing to connect the dots.

And those who connect them early get a chance to prepare, while everyone else laughs until it’s too late.

Don’t Laugh at the Weird Indicators…They Might Save You

Hot chicks in eviction court. Boat fires. Subprime lender blowups. Margin compression from phantom price cuts.

These aren’t jokes. They’re the early warnings.

Because just like in 2007, the data doesn’t scream “crash.” It whispers it…in the margins, in the anecdotes, in the things no one tracks.

And if you wait for the headlines, it’ll be too late.

The key to investing isn’t following the herd…it’s reading the signals before the herd sees them.

In markets, the punchline always comes at the expense of those who ignore the setup. That’s why trade positioning matters now more than ever…and why smart money is already moving.

Trade Ideas: Positioning for a Cracking Consumer

1. Short Subprime Auto Lenders (e.g., ALLY): If Tricolor is the canary, others will follow.

2. Short Homebuilders (e.g., LAR, ITB): Margin pressure, fake comps, and falling affordability mean trouble ahead.

3. Long Gold and Miners: As consumer stress rises and the Fed pivots to easing, real assets outperform.

4. Long Duration Treasuries (TLT): If credit markets freeze and the economy tanks, long bonds rally.

5. Long Volatility (VIX Calls or VIXY): Everyone is asleep at the wheel. That’s when volatility strikes.

These aren’t just theoretical plays…they’re asymmetric opportunities most investors will miss until the moves are already over. And that’s where Rebel Capitalist News Desk comes in.

If you’ve been relying on CNBC or Bloomberg to tell you when to act, you’re already behind. The real signals…the ones that matter…rarely make the headlines until it’s too late.

At Rebel Capitalist News Desk, we cut through the noise and deliver the kind of analysis you just read…every single week.

Subscribers get:

George Gammon’s Weekly Wrap-Up (straight talk, no fluff).

Actionable trade ideas before they hit the mainstream.

Macro insights you won’t find anywhere else…from credit cracks to global liquidity shifts.

Thousands of contrarian investors already use Rebel Capitalist News Desk to protect and grow their wealth.

Don’t wait until the weird indicators become the front-page story.

👉 Subscribe today and join the movement of liberty-minded investors who see what’s coming…and position for it before anyone else.

Come for the hot chicks...stay for the trade ideas.

I remember the housing market collapse in Alaska of the 1980’s. The number one cause of house fires was the mortgage rubbing up against the insurance.