Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | October 10, 2025

Everyone’s pounding the table on gold and silver. And why wouldn’t they?

Gold is trading north of $4,000. Silver’s over $50. Bitcoin is brushing up against all-time highs.

The mainstream narrative is clear: this is the debasement trade.

The Fed has printed too much, the dollar is toast, and now we’re finally seeing it play out in real time.

But what if that narrative is wrong?

In this post, we’re going to do what we always do at Rebel Capitalist: challenge the consensus.

We’ll dig into the actual rate of money supply growth, compare past inflationary episodes, and break down why the mechanics of today’s monetary system might tell a completely different story than the price action in gold.

More importantly, we’ll show you a strategy…used by seasoned pros…that lets you profit regardless of whether the debasement trade is real or just a collective hallucination.

The Narrative vs. the Numbers

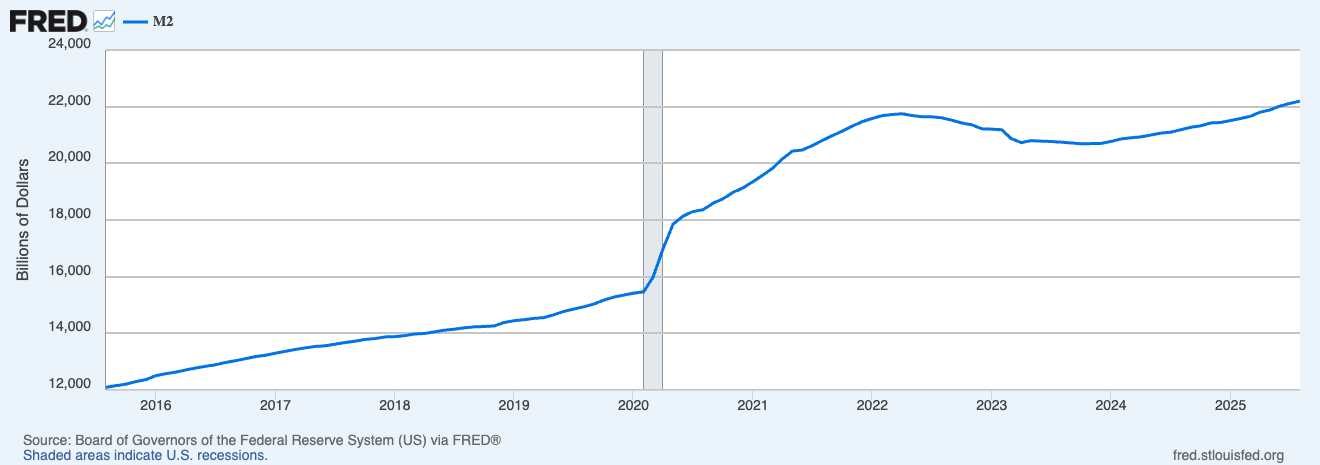

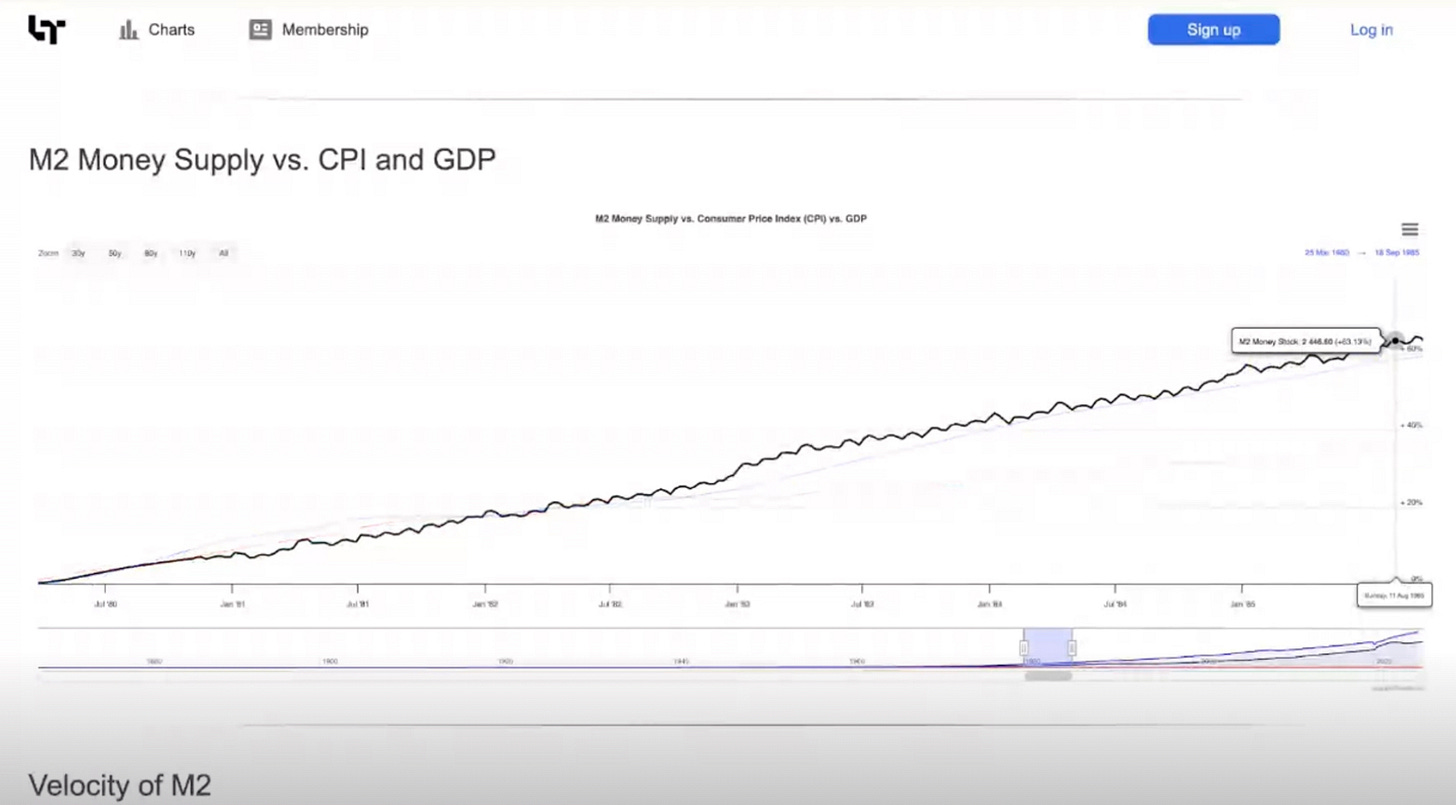

You’ve probably seen the M2 money supply chart that goes vertical post-2020.

It’s the classic argument for currency debasement: “look at all these new dollars! Of course gold is up!”

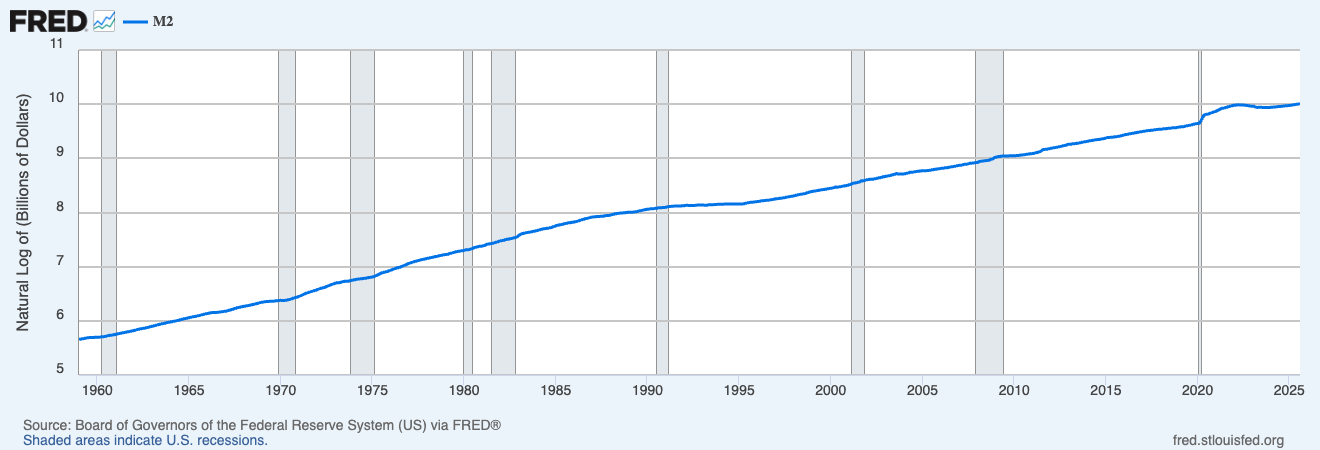

But that’s just the aggregate. What matters more is the rate of change. And when we switch to a log scale…revealing percentage growth year-over-year…a different picture emerges.

From 1960 to 1980, M2 grew at a faster clip than it has over the past five years.

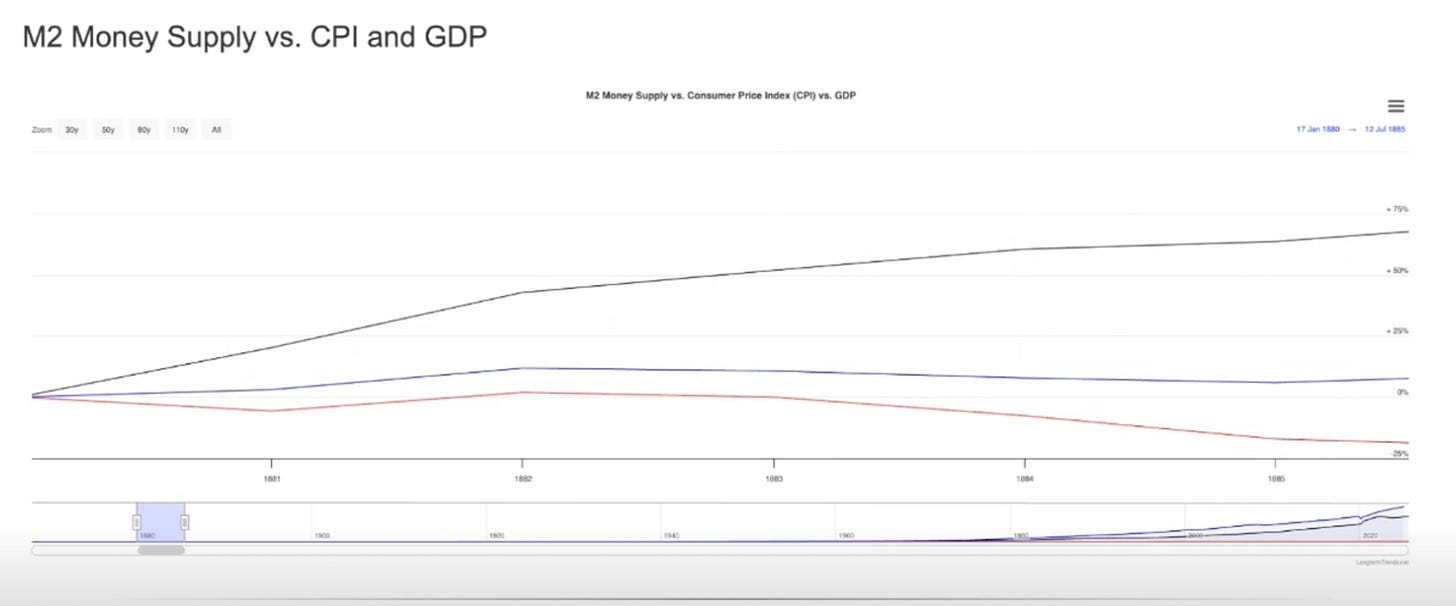

Even the supposedly “sound money” era of 1880–1885, when the U.S. was on the strictest gold standard in its history, saw M2 rise by nearly 70%.

That’s more than the 43% increase we’ve seen from 2020 to 2025.

Let that sink in.

If gold’s rise can’t be explained by simple money printing, then something else…something psychological, structural, or geopolitical…is driving this move. And that’s where things get interesting…

What Really Drives Inflation?

If gold is sniffing out future inflation, shouldn’t we see a mechanical driver behind it?

Let’s go back to 1980–1985…a period of major disinflation. What did M2 do then?

It increased by 60%.

Compare that to:

2000–2005: ~40%

2010–2015: ~40%

2020–2025: ~43%

In other words, today’s money supply growth is not unusual in historical context.

In fact, we’ve had much higher growth during periods when gold and silver prices were declining.

So again, we come back to the central question: if it’s not debasement, what’s really driving gold and silver higher?

If inflation isn’t the culprit, then investors may be reacting to something even more profound…loss of confidence in the system itself. And confidence, once shaken, rarely returns quietly.

Narrative Is Not Reality (But Still Matters)

Here’s the contrarian insight: the narrative of debasement may be false…but it still drives prices.

Markets don’t care about your charts. They care about collective beliefs. If enough people believe the Fed has lost control and gold is the answer, then that belief alone can send prices to the moon.

So, while the mechanical truth might be disinflationary, the market is behaving as if hyperinflation is around the corner. And that creates a dilemma for smart investors.

Do you trade the truth? Or do you trade the narrative?

Answer: you do both.

Because when narrative and reality collide, that’s when volatility explodes…and that’s precisely where professionals make their fortunes.

Enter the Yield Curve Trade

This is where the professionals separate themselves from the amateurs.

Instead of going all-in on the debasement trade (buying gold, silver, Bitcoin), the pros are playing the yield curve.

Here’s how it works:

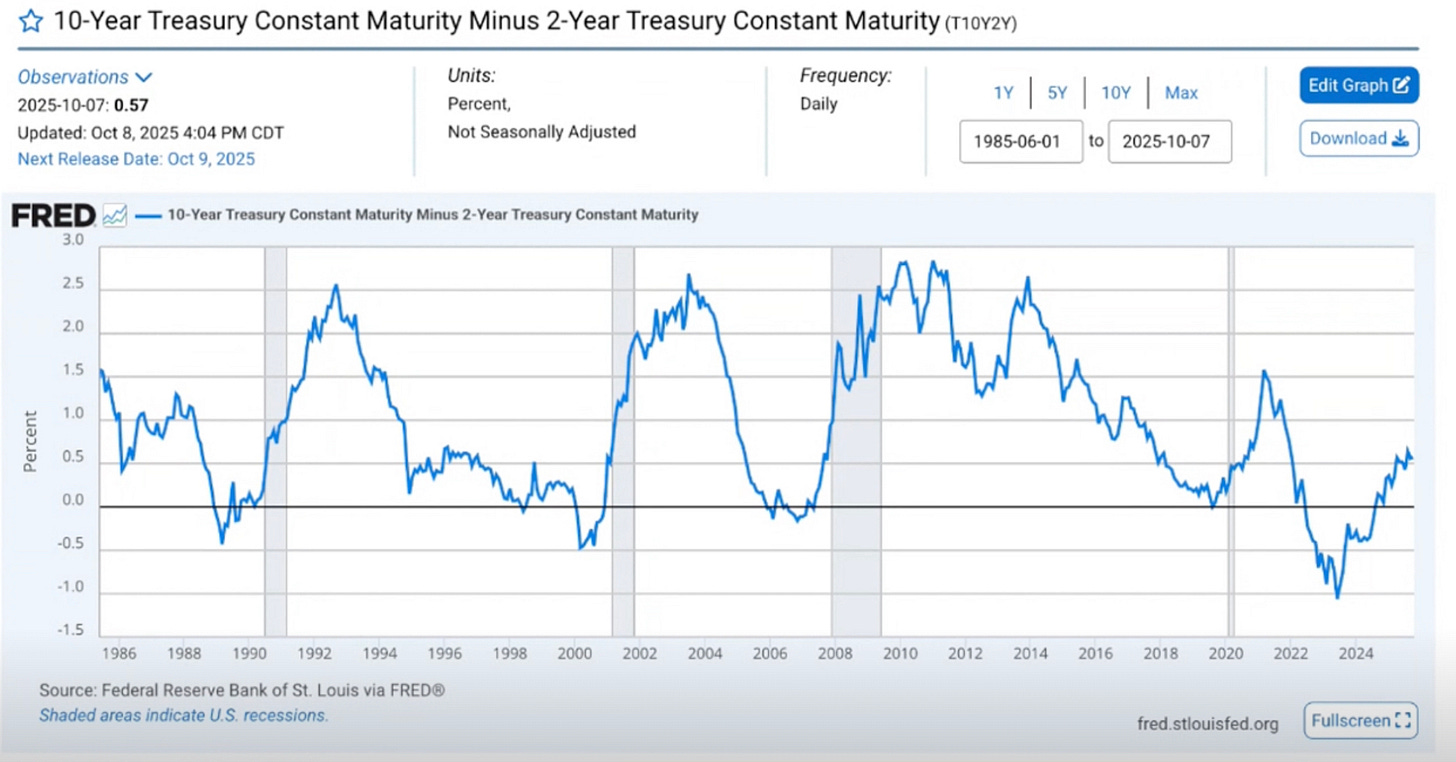

The 2s10s yield curve (difference between 2-year and 10-year Treasuries) inverted hard over the past year.

It has now uninverted and is steepening again.

Historically, when the curve steepens from an inversion, it usually moves from -50 bps to +250 bps.

That’s a massive move.

And it happens regardless of whether the future is inflationary or disinflationary.

Why?

In a disinflationary scenario: The Fed cuts rates aggressively, dropping the short end faster than the long end.

In an inflationary scenario: Long-term yields rise faster than short-term rates due to inflation expectations.

Either way, the spread widens. And if you’re long the spread…i.e., positioned to benefit from a steeper curve…you win.

It’s the kind of setup Wall Street whispers about in quiet rooms…because when it works, it pays like a lottery ticket. The trick is knowing when the shift begins.

How to Play It

Let’s be clear: this is not investment advice. But here’s a simplified version of how the trade works:

Long the 2s10s Spread

You can construct this using futures (e.g., short 2-year Treasury futures, long 10-year futures).

Set Risk Parameters

This isn’t a YOLO trade. The move from 45 bps to 55 bps already happened. If you’re entering now, understand the volatility.

Size Appropriately

This isn’t an all-in bet. It’s a hedge…designed to profit regardless of whether inflation or deflation wins.

Watch for Narrative Shifts

If gold and silver prices start to turn…even as the curve steepens…it’s a clue that the market is rotating narratives again.

When that rotation happens, the herd will be caught flat-footed…because they’re still arguing over inflation versus deflation while the real trade plays out quietly in the bond market.

The Pros Play Both Sides

Here’s the takeaway: professionals aren’t just betting on gold because they believe in debasement. They’re also putting on trades that profit if the market wakes up and realizes the narrative was wrong all along.

That’s the essence of asymmetric investing:

If gold goes higher, you win.

If disinflation dominates and rates drop, you win.

If inflation surges and long yields spike, you win.

And if the market just chops sideways? You’ve got optionality built into your positioning.

That’s how the game is played at the highest level.

The amateurs chase headlines…the pros chase probabilities. The question is…which camp will you be in when the next shift hits?

What About the Fed?

The ultimate wildcard in all this is Fed policy.

If Powell restarts QE, initiates yield curve control, or monetizes fiscal deficits, then yes…the debasement argument gets stronger. M2 could explode. Velocity could rise. Inflation could accelerate.

But none of that is happening yet.

In fact, M2 growth is slowing. Bank lending is flat. The Fed has been reducing its balance sheet. And most importantly, banks aren’t playing ball. They’re not creating new money via lending. They’re still in risk-off mode.

As George likes to say, “The banks are the arbiters of truth in this monetary system…not the Fed.”

And if that truth holds, the real story of 2025 won’t be runaway inflation…it’ll be what happens when the market finally realizes it’s been trading the wrong narrative all along.

Be the House

Everyone wants a simple narrative:

Buy gold because the dollar is toast.

Buy Bitcoin because the Fed can’t stop printing.

Short the dollar because the BRICS are launching a new currency.

But the real pros don’t care about simple narratives. They care about odds, asymmetry, and playing both sides.

That’s what this yield curve trade represents.

It’s not a bet on inflation or deflation.

It’s a bet that no matter which narrative wins, the curve is going to move. And the spread is going to widen. And you’re going to get paid.

It’s not sexy. It’s not going to make you rich overnight. But it’s the kind of strategy that separates Rebel Capitalists from Reddit traders.

And in a world where everyone’s playing checkers, it pays to play chess.

Want to Go Deeper? Ask George Gammon Questions.

If you’ve ever wished you could bounce an idea off George Gammon…whether it’s a business question, a money question, a macro idea, or a deep dive into central-bank plumbing…now’s your chance.

Every Friday after market close, George hosts his Rebel Capitalist Weekly Wrap-Up, exclusively for paid subscribers. It’s where he breaks down the biggest moves in markets, connects the dots the mainstream misses, and answers subscriber questions live.

After you upgrade, your welcome email includes instructions on how to submit your questions directly to George before each Friday wrap-up.

Imagine getting real-time insight from someone who’s navigated everything from repo market chaos to emerging-market currency crises…someone who actually lives and breathes the macro plumbing that moves your money.

Whether you’re an investor looking for clarity, a business owner preparing for the next policy shift, or just a freedom-minded thinker trying to stay ahead of the curve…this is your direct line to one of the sharpest macro minds alive.

👉 Upgrade today and join the thousands of contrarian investors who already use George’s weekly sessions to sharpen their thinking, protect their capital, and seize opportunities before the herd even notices.