Imagine waking up to headlines screaming “Boom Times Ahead!” while your neighbor whispers over the fence about quietly packing boxes for a cross-country move. The job market feels like that awkward family reunion...everyone’s smiling for the photo, but beneath the surface, tensions simmer.

Last week’s economic data painted a portrait of quiet desperation: a labor force that’s not just slowing, it’s reversing into neutral.

Non-farm payrolls, after revisions, showed outright losses, and the ADP employment report clocked in at a chilling negative 32,000 jobs...the fourth negative print in the last six months.

That’s not a blip; it’s a siren.

When payrolls dip negative consistently, outside of freak events like massive strikes or biblical floods, it screams economic contraction. No footnotes, no excuses...just cold, hard reality.

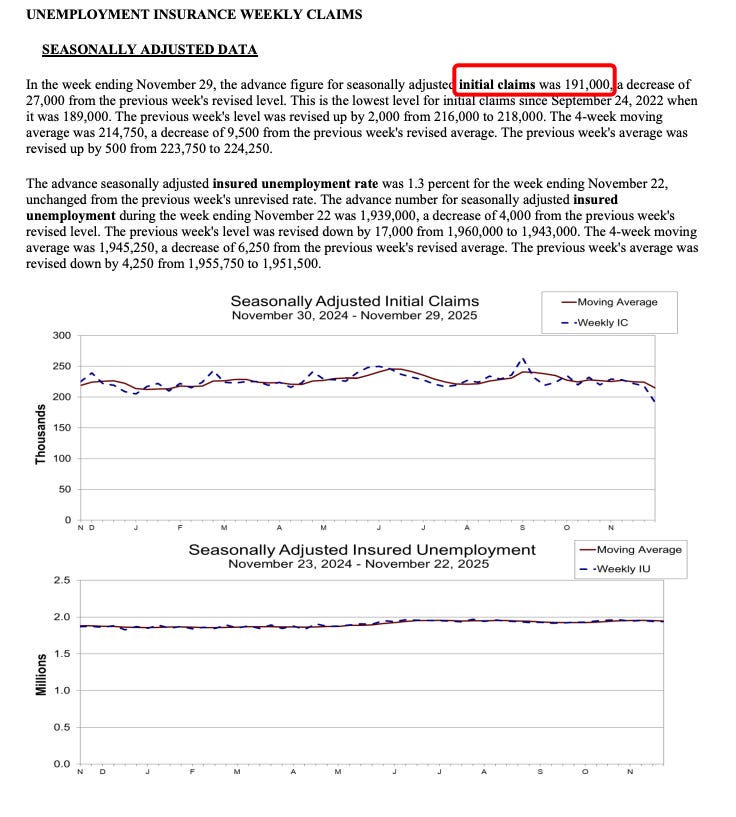

But here’s the twist that keeps economists up at night: initial jobless claims hit 191,000, the lowest since 1969.

Picture this: a nation of 330 million souls, versus a population a fraction of that back in the groovy ‘60s, and yet fewer people are lining up for unemployment checks than ever.

How does that square with shrinking payrolls? Is the system rigged, or are we witnessing a stealthy unraveling?

Stick around, because the explanation isn’t about mass firings...it’s about something far more insidious, and it ties straight into the housing nightmare unfolding right now.