Worse Than 2000? Why This Bubble Is Measured in Trillions, Not Millions

Why the smartest tech, backed by the dumbest money, is fueling a mega AI super bubble...

Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | September 30, 2025

The dot-com bust is back. Only this time, it’s dressed in a hoodie and powered by trillion-dollar GPUs.

Last week, hedge fund legend David Einhorn broke Wall Street’s favorite illusion wide open: the AI boom isn’t the next industrial revolution…it’s the next capital-destroying bubble.

And unlike the dot-com mania of the late ‘90s, this one is bigger, faster, and more dangerous because it’s entangled with trillions in passive flows and government-backed liquidity.

We’ve all heard the breathless hype…AI will change the world, AI will create trillions in value, AI is the “new electricity.”

But here’s the part no one wants to say out loud: that doesn’t mean it’s a good investment.

Not at these valuations. Not with this spending. And not with the eerily familiar circular logic that feels like 1999 all over again.

In this article, we’ll break down the red flags everyone’s ignoring, connect the dots between Nvidia and Enron, and show why the AI bubble could trigger a financial chain reaction worse than anything we saw in 2000.

When Enron Met Nvidia

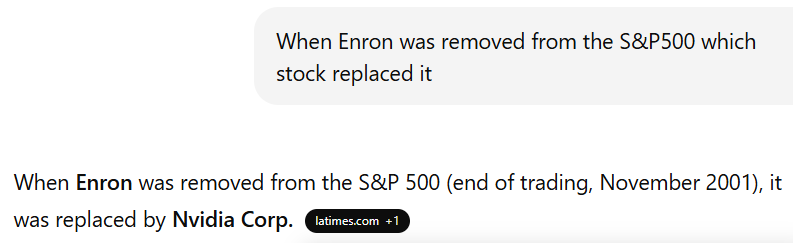

It’s more than symbolic: when Enron collapsed in 2001, Nvidia was the company that replaced it in the S&P 500.

Now, Nvidia is arguably the poster child for this AI boom…holding up a third of the index’s gains this year.

Nvidia is to AI what Cisco was to the internet…critical infrastructure, overvalued, and destined to break hearts.

The entire S&P 500 now hinges on a single stock that benefits from the AI spending boom. But what if that spending boom isn’t sustainable?

If Nvidia really is today’s Cisco, then investors should ask themselves: how long before the parallels with Enron come full circle?

The warning signs aren’t hidden…they’re sitting in plain view.

But the question nobody wants to answer is this: what happens to the entire S&P 500 when its foundation rests on a single, overextended pillar?

The Math Doesn’t Work

According to Einhorn and others, the biggest issue isn’t that AI companies have no revenue. It’s that they have some revenue…but nowhere near enough to justify their capital expenditures.

Take OpenAI. Sam Altman has said they want to spend $1 trillion per year on data centers and infrastructure.

Even in a steady state, ChatGPT itself might require $50–100 billion annually just to operate. And what are they making in revenue today? Roughly $12 billion.

That’s like taking out a billion-dollar student loan to get a job that pays $100K. You don’t need a finance degree to see the problem.

This spending spree is benefiting hardware providers like Nvidia today.

But it’s all based on the assumption that OpenAI and similar companies will somehow, eventually, be profitable enough to justify this level of investment.

History…and common sense…say otherwise.

The mismatch between trillion-dollar spending plans and billion-dollar revenues isn’t just unsustainable…it’s mathematically impossible.

Everyone cheers the infrastructure buildout today, but when the bills come due, who’s left holding the bag?

That’s the part Wall Street would rather you not think about…yet it’s the part that determines whether this ends with fireworks or ashes.

The Circular Economy Illusion

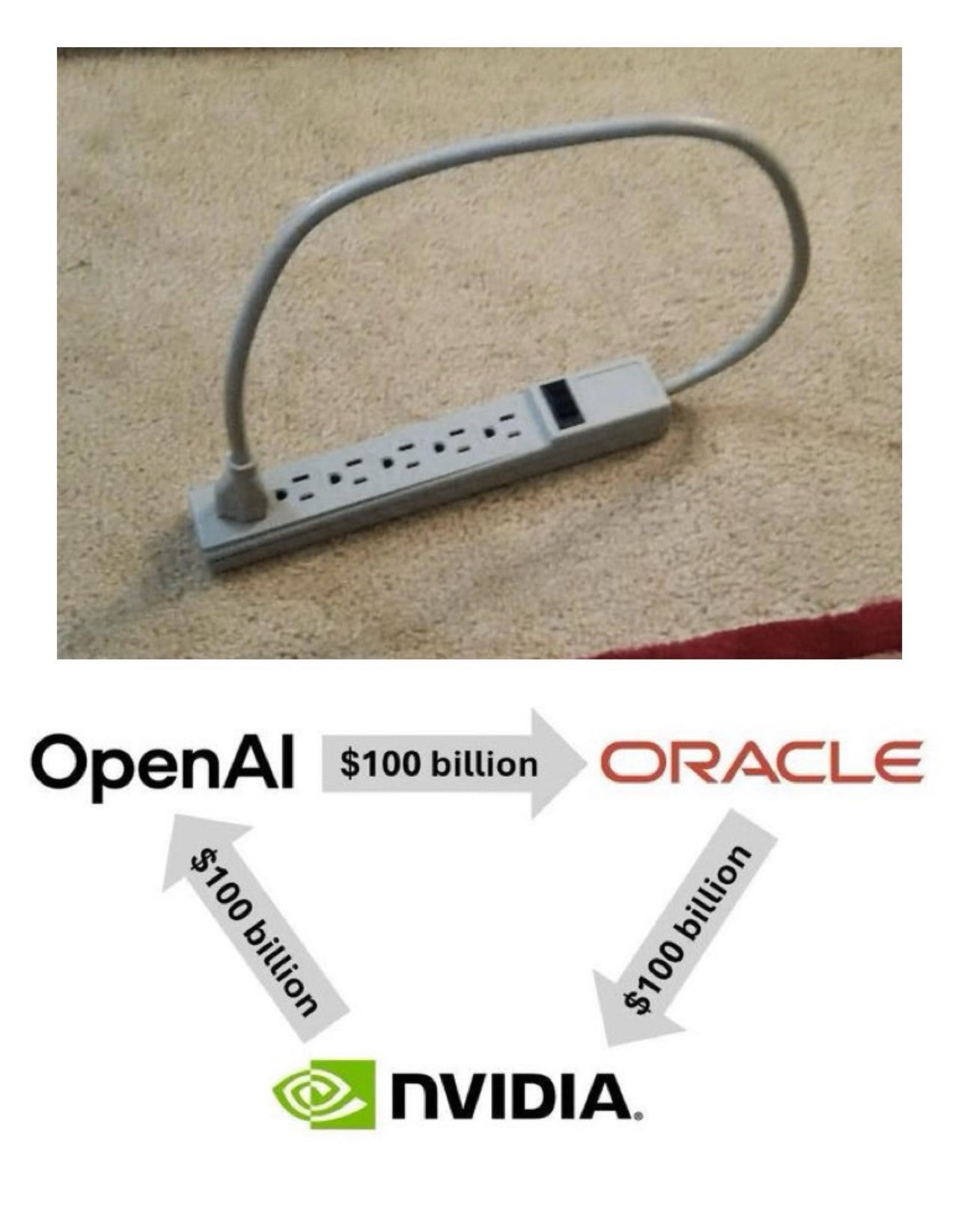

The AI economy is starting to resemble a feedback loop.

AI companies raise capital or use inflated equity to buy infrastructure (GPUs). That infrastructure is sold by companies like Nvidia, which see their share prices rise. The cycle repeats.

It’s financial engineering, not sustainable economics. And it only works as long as capital is freely flowing into the system…via passive inflows, government subsidies, or speculative bubbles.

Once the flow stops? The whole thing collapses like Enron’s “black box” accounting.

When “growth” comes from capital shuffling in circles, you don’t have a revolution…you have a Ponzi scheme in disguise.

The real danger isn’t just the fragility of this cycle, but how violently it will unwind once the easy money stops flowing.

And history shows: it always stops.

Vendor Financing and Vaporware

Back in the early 2000s, Enron was accused of hiding losses through opaque financial structures and circular transactions.

Nvidia, today, isn’t doing anything illegal…but it’s benefiting from a similar lack of transparency around who’s actually buying what, and whether they can afford it.

What we’re seeing is a form of vendor financing…AI companies borrow or raise capital, buy Nvidia chips, Nvidia’s earnings explode, and retail investors pour more money into Nvidia.

But none of this is driven by real consumer demand or economic productivity. It’s just reshuffling capital.

If this sounds like vaporware, that’s because it probably is.

Here lies the fatal echo of Enron: dazzling numbers propped up by opaque flows of capital with little connection to reality.

Nvidia may not be cooking its books, but its customers are cooking their balance sheets.

The only question is how long before investors realize they’ve been financing vaporware all along.

The Passive Problem

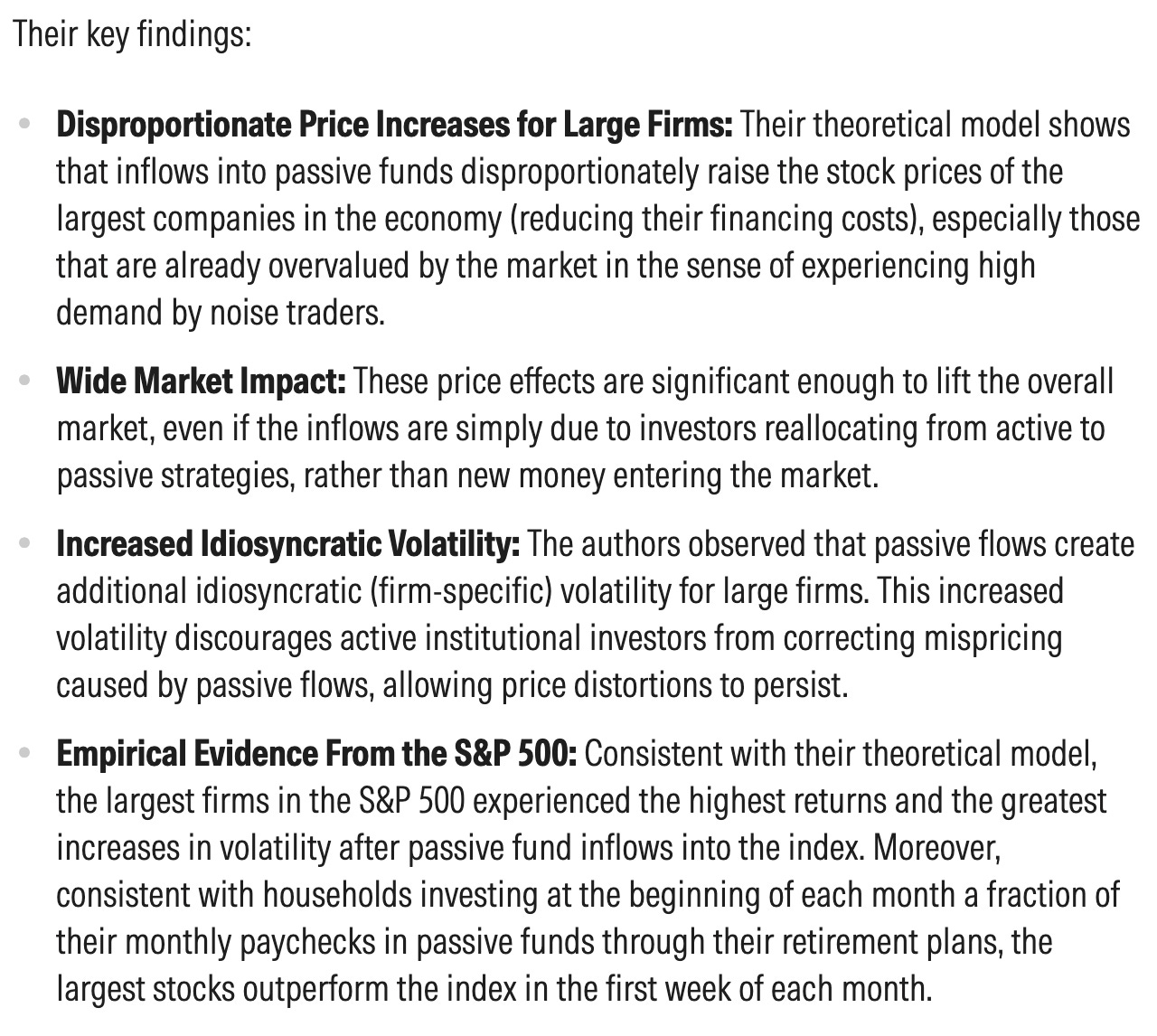

Hao Jiang, Dimitri Vayanos, and Lu Zheng, authors of the March 2025 paper “Passive Investing and the Rise of Mega-Firms,” set out to understand how the increasing shift from active to passive investing influences asset prices, particularly the prices of the largest firms in the market.

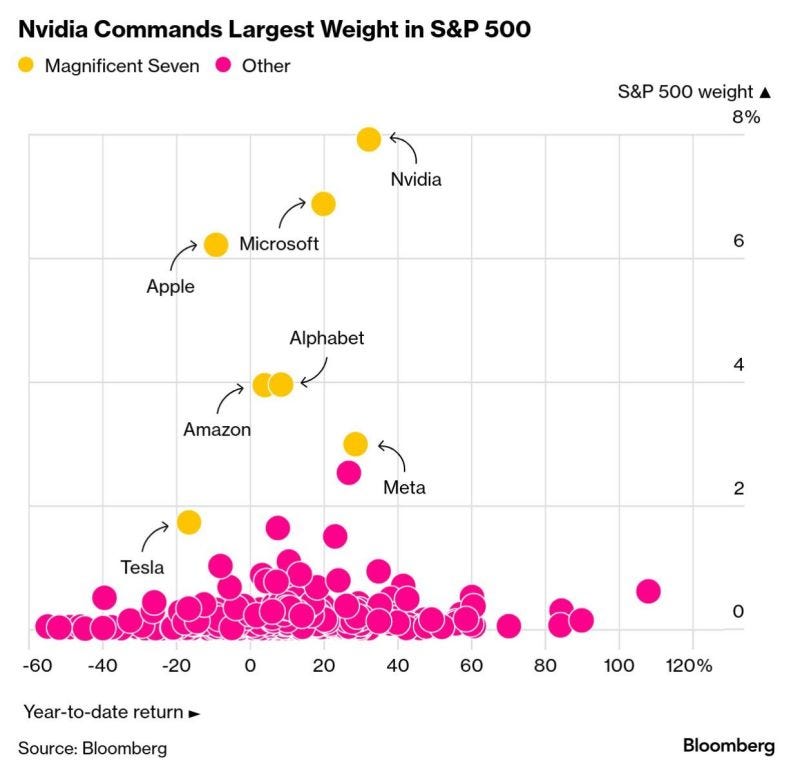

A large chunk of Nvidia’s share price inflation is being driven by passive investing.

If the company is in the S&P 500, and index funds buy the index every month, money automatically flows into Nvidia…regardless of fundamentals.

This is why the average investor thinks, “I don’t own Nvidia, I just own the S&P 500,” not realizing Nvidia is 8% of the entire index.

If Nvidia drops, the whole index drops.

If the index drops, so does the economy…because we’ve financialized everything.

This isn’t just about Nvidia…it’s about the system itself.

Passive flows don’t care about risk, valuation, or cash flow; they buy because they have to. That blind buying turns fragile into explosive.

And when the cycle reverses, the fallout won’t be limited to one stock…it’ll hit every 401(k), every pension fund, every so-called “safe” portfolio.

The K Economy Turns Into an h

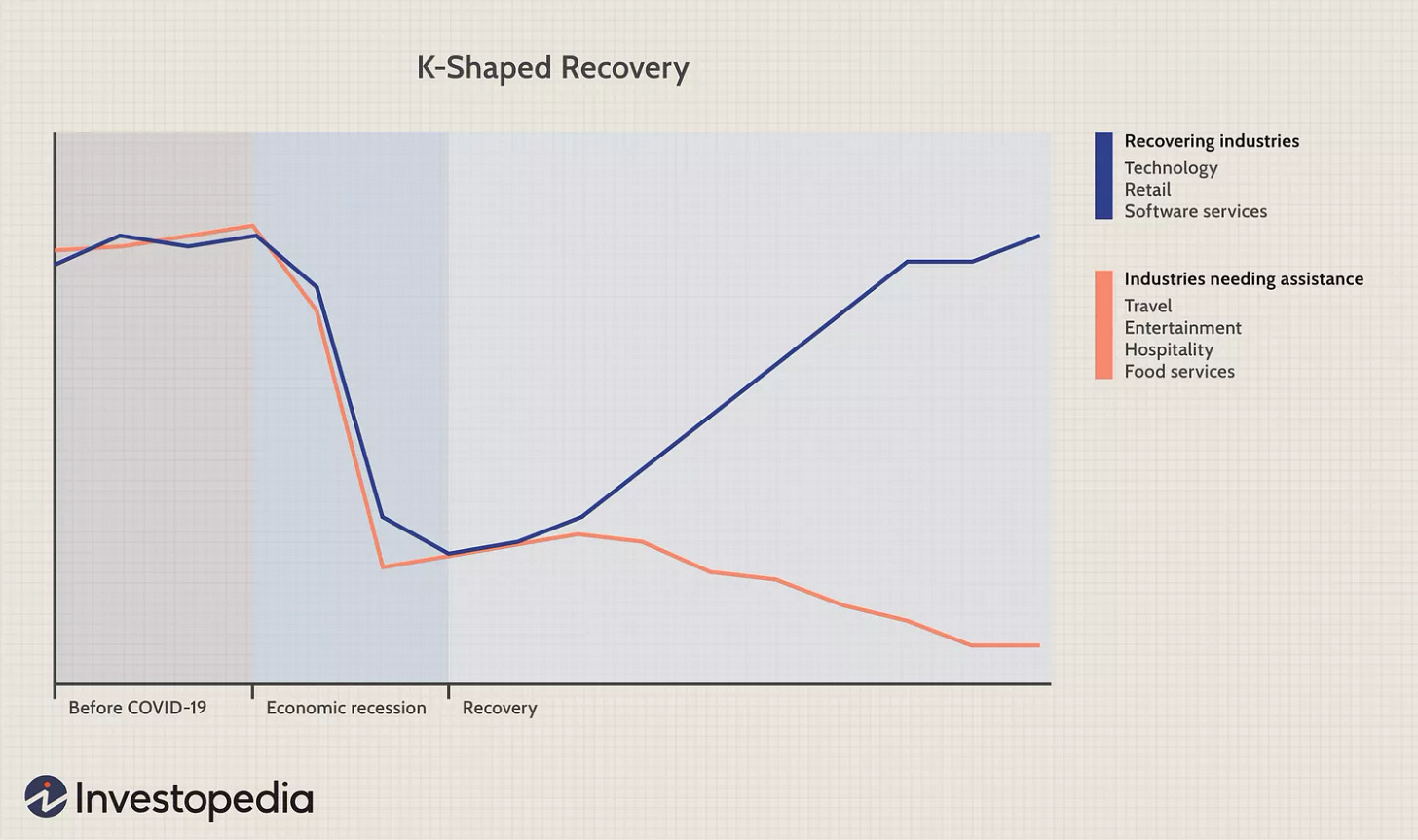

Right now, the U.S. economy is a classic “K-shaped recovery.”

Those with assets…like tech stocks…are spending and supporting growth. Those without are stuck in recession.

But if Nvidia collapses, the top leg of the K disappears. What we’re left with is an h-shaped economy: no upside, just stagnation.

In that world, the illusion of growth evaporates. The wealthy feel poorer. Spending falls. The feedback loop reverses.

Strip away the top of the K, and the entire economy collapses into something uglier than stagnation.

The veneer of prosperity evaporates overnight. And here’s the kicker: once the illusion is gone, there’s no easy way to put it back together again.

Could the Government Step In?

Don’t laugh. If Nvidia crashes and takes the S&P with it, don’t be shocked if the government intervenes…maybe even buying equity in strategic AI firms.

After all, if we’ve merged the Fed and the Treasury (as discussed last week), then why not go full Soviet and nationalize the GPU supply chain?

It sounds insane…until it happens.

A state-backed bailout of America’s most overvalued company sounds absurd…until you remember the playbook of the last two decades.

If they can nationalize mortgages, banks, and auto companies, why not GPUs?

Intervention won’t stop the collapse; it’ll just ensure taxpayers foot the bill when the bubble bursts.

Worse Than 2000?

Is this worse than the dot-com bust?

In some ways, yes. At least back then, companies were losing millions.

Today, we’re talking trillions.

And it’s all happening in a world with:

No bond vigilantes.

No fiscal discipline.

No price discovery.

And trillions in passive flows propping up mega-cap stocks.

This is financial Jenga. And we’re removing the last few blocks.

The dot-com bust erased trillions, but today’s bubble is bigger, faster, and far more entangled with the entire financial system.

Back then, investors lost paper wealth.

This time, the collateral damage could be the system itself. The tower is swaying…and the next block pulled might bring the whole thing down.

The AI bubble isn’t a sideshow…it’s the main event.

And if Einhorn is right, we’re standing at the edge of a financial reset that could rival or even surpass the dot-com crash.

The problem is, most investors won’t see it until their portfolios are already bleeding.

That’s why you need to be ahead of the crowd. At Rebel Capitalist News Desk, we track the cracks before they become collapses…arming you with the charts, data, and contrarian analysis Wall Street won’t touch.

👉 Join the thousands of liberty-minded investors who refuse to be blindsided.

Upgrade to a premium subscription today for exclusive deep dives, George Gammon’s weekly wrap-ups, and insider strategies you won’t find anywhere else.

The AI bubble will burst. The only question is: will you be prepared…or blindsided?

Thank you for being a paid subscriber. We wouldn’t be doing this without your support.

CRONYISM is just rebranded communism, let me explain in this podcast:

https://open.substack.com/pub/soberchristiangentlemanpodcast/p/essay-the-cronyism-deception-unmasking?utm_source=share&utm_medium=android&r=31s3eo

Lovely!