Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | October 16, 2025

You know things are getting bad when even CNBC starts telling the truth.

This week, the mainstream media...yes, the same group that told you the economy was “booming” just a few months ago...finally admitted what anyone outside of a hedge fund or Georgetown dinner party has known for years:

The U.S. economy is a K-shaped illusion built on asset bubbles...and it’s about to implode.

It’s the fatal flaw no one in Washington wants to admit: the economy is no longer driven by productivity or wages. It’s propped up by financialized wealth effects that disproportionately benefit the asset-rich.

And now that CNBC has stumbled upon the truth, it’s time we lay out exactly why this system is rigged to collapse...and what you can do about it.

If even the cheerleaders are starting to whisper the word “collapse,” what happens when the music stops?

Before we get there, let’s look at the so-called “shocking” data that jolted CNBC out of its fantasy...and why it’s just the opening act.

The CNBC “Shocker” That Shouldn’t Have Shocked Anyone

Let’s start with the article that triggered today’s rant.

In what CNBC called a “shocking disparity,” JPMorgan’s latest consumer data revealed a wide and growing gap in economic sentiment between high-income and low-income Americans.

Wealthier households think the economy is doing fine; lower-income groups say it’s falling apart.

This isn’t news...it’s the lived experience of every working-class American. But for CNBC and their economist buddies, this is some kind of mind-blowing revelation.

It’s not a new trend. It’s the inevitable result of building an economy around asset prices instead of real productivity.

If the data finally shocked Wall Street, it’s because they’ve never lived Main Street. But the divergence between the haves and have-nots isn’t just social...it’s structural.

And once you see it through the lens of the K-shaped economy, the illusion of prosperity starts to unravel fast.

The K-Shaped Economy in Action

The concept of a “K-shaped recovery” became popular after 2020. But what does it really mean?

It’s simple:

The top leg of the K is asset owners...those with real estate, tech-stocks, and retirement accounts.

The bottom leg is wage earners...those living paycheck to paycheck, with no portfolio to fall back on.

When the Fed pumps liquidity and Congress signs trillion-dollar stimulus bills, where does the money go?

Into asset prices.

Not into wages. Not into productivity. Not into sustainable economic growth. Into bubbles.

And that’s the punchline: the economy has become completely dependent on asset inflation.

Your house goes up $150K? Great...now go book a vacation and splurge on dinner. Your 401(k) just hit an all-time high? Fantastic...buy the car, upgrade the kitchen, go out more.

But what happens when asset prices fall? The entire top leg of the K crumbles. And with it, the U.S. economy.

A system built on inflated balance sheets instead of real output is like a skyscraper on sand. And the higher it climbs, the harder it falls.

But here’s the part most people miss...the illusion isn’t just in the numbers. It’s in how Americans feel about wealth.

When the “Feeling” of Wealth Drives Spending

This is the core problem: Americans don’t feel wealthy because of income. They feel wealthy because Zillow says their house is worth more than last year.

“It’s not income that makes people feel rich. It’s the value of their 401(k) and home equity...and that’s all paper wealth.” -George Gammon

If you removed the wealth effect from asset inflation, the economy would be in freefall. Most Americans...yes, even those earning six figures...would realize they’re barely treading water.

So why does the top leg of the K still feel optimistic? Because they believe this wealth is permanent. Because the Fed will always bail them out. Because asset prices “only go up.”

It’s the same psychology we saw in 1999. And 2006. And 2021.

That “feeling” of security is the biggest bubble of all…and when emotions drive economics, logic gets priced out of the market. But it’s about to collide with something that no amount of optimism can inflate: math.

The Valuation Nightmare No One Wants to Talk About

Let’s talk about the S&P 500.

As of this writing, the CAPE ratio (Shiller PE) is hovering around 39...a level seen only in two prior moments: the dot-com bubble and the Great Depression.

What happened after those peaks?

In 2000, the Nasdaq lost 78% of its value.

In 1929, the stock market collapsed, leading to a decade-long depression.

Yet today, people still argue this time is different. They say the S&P is a “safe long-term investment.” They tell you to buy the dip. And they mock anyone who raises red flags as a “doom-and-gloomer.”

But here’s the thing:

Every time valuations reached this extreme, the long-term returns were disastrous.

So ask yourself: are you holding assets with 100% upside or 80% downside?

Because if the answer is the latter, you’re not investing. You’re gambling.

When everyone’s playing musical chairs with blindfolds on, the question isn’t if the music stops...it’s when. And when it does, one asset class in particular will expose just how fragile this “prosperity” really is.

Housing: The Other Bubble No One Wants to Admit

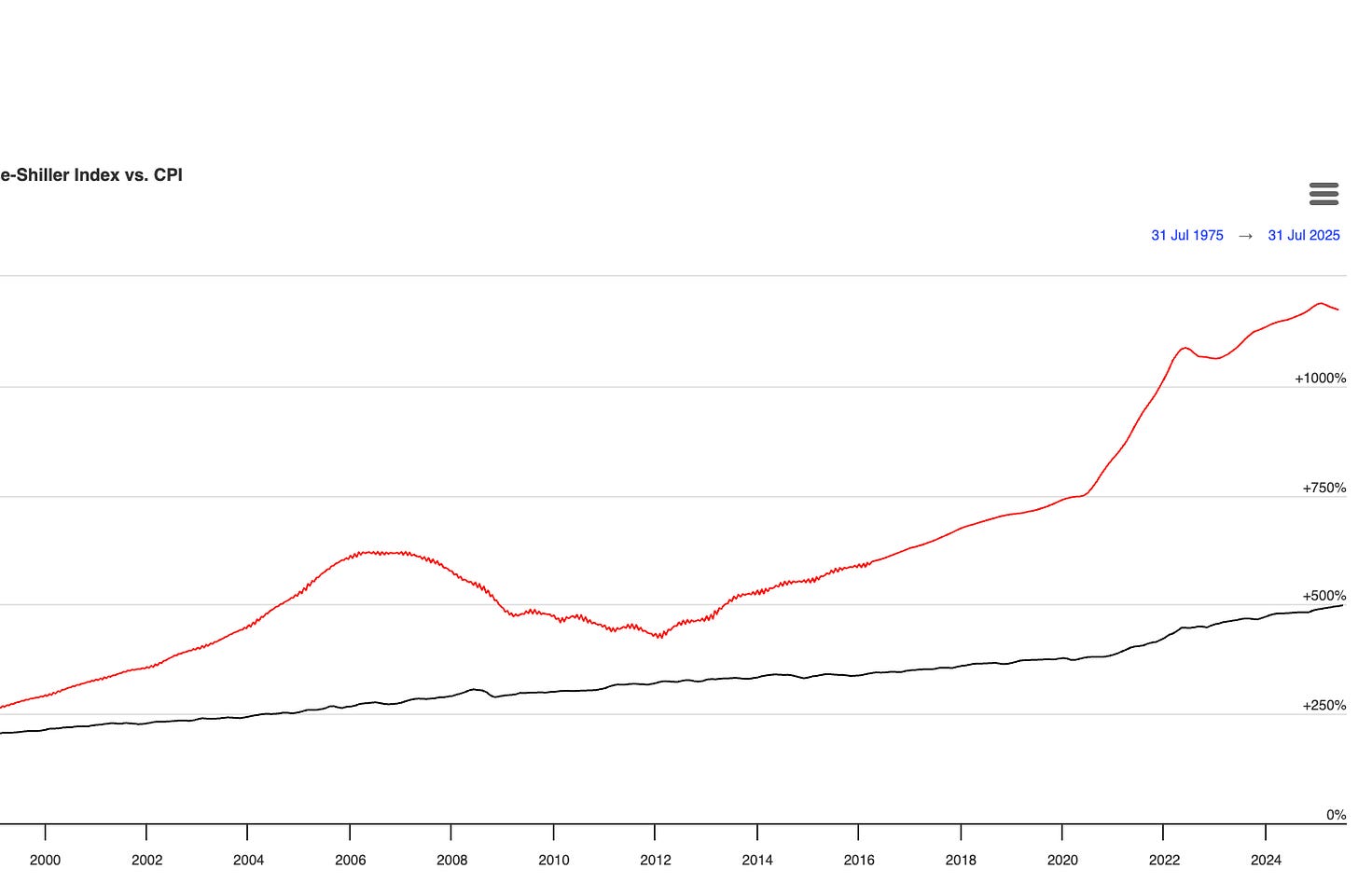

The same delusion applies to real estate.

Home prices are at historic highs relative to income.

For over a century...from 1900 to 2000...housing prices tracked inflation and wages almost perfectly. Then something broke.

Starting in the early 2000s, prices decoupled from income...a trend that led to the 2008 housing crash. After a brief correction, the trend resumed, and now the gap is even wider.

Today, median home prices have outpaced inflation-adjusted income by 2–3x. And yet, we’re told “this time is different.”

Could prices keep going up? Sure. Just like you could hit on a 19 at the blackjack table and get a two. But that doesn’t make it a smart play.

Investing isn’t about what happens next. It’s about what’s likely to happen over time.

And betting on home prices doubling from here isn’t a high-probability trade.

The last time people said housing could “never go down,” the global economy nearly imploded. Yet here we are again, same script, same hubris...only this time, the stakes are higher. Because the illusion of prosperity isn’t just in homes or stocks. It’s in the entire system.

The Illusion of Permanent Prosperity

Here’s the uncomfortable truth CNBC and the establishment are just now realizing:

The U.S. economy is no longer based on production. It’s based on paper gains.

401(k) balances going up = “strong economy”.

Home equity increasing = “consumer confidence”.

Stock buybacks = “bull market”.

None of these are rooted in sustainable output. None are tied to increases in productivity. It’s all based on capital gains...leveraged, speculative, and artificial.

This is why the mainstream economic narrative flips based on who’s in office. When one party’s in power, the economy is “booming.” When the other is, it’s “broken.” But the fundamentals haven’t changed. Only the excuses have.

When prosperity depends on the next bubble, there’s no such thing as stability...only the illusion of it. And when that illusion fades, it won’t just be markets that get crushed. It’ll be the investors who trusted the system instead of understanding it.

Why Most Retail Investors Will Get Wiped Out

The fatal flaw isn’t just that asset prices are in a bubble. It’s that most Americans are now depending on those bubbles to retire.

They’re not investing based on valuations. They’re investing based on vibes, FOMO, and TikTok advice.

And when the market turns, they’ll do what they always do:

Buy the dip too early.

Hold through the first leg down.

Panic sell near the bottom.

Vow never to invest again.

Instead of retiring on a yacht, they’ll be working as greeters at Walmart.

And here’s the scariest part: this time, the economy itself is more dependent on those retail investors than ever before.

When Main Street becomes the margin account for Wall Street, you don’t just risk losing your savings...you risk losing the very foundation of the economy.

And that’s why the next section matters, because it’s not about if the bubble bursts…it’s about how deep the crater goes.

What Happens When the Bubble Pops?

Let’s game it out:

Stocks fall 40%.

Housing declines 20–30%.

Retirement accounts shrink.

Consumer spending crashes.

The “wealth effect” turns into a poverty spiral.

In a productivity-based economy, that would hurt…but not cripple...growth. But in today’s asset-driven model, it could be a fatal blow.

Once the illusion breaks, you can’t unsee it...and you can’t unfeel it when your account balance drops 40%. But that’s exactly when opportunity emerges for those who prepared. So how do you prepare without panicking? Let’s talk strategy.

So What Do You Do?

Let’s be clear: the answer isn’t to sit in cash forever. It’s to recognize where the odds are in your favor.

“I’m not calling tops. I’m looking for asymmetric bets.” -George Gammon

If the S&P is priced for perfection, and housing is priced for delusion, where can you go?

Gold and gold miners (undervalued vs. financial assets).

International value stocks (like Greece, yes, really).

Energy (especially uranium and oil producers).

Select emerging markets.

The goal isn’t to predict. It’s to position yourself for probability.

That’s the edge...seeing the game for what it is and playing smarter, not louder. But spotting these asymmetric setups before they hit the headlines? That’s where having the right guide makes all the difference.

The Fatal Flaw Isn’t the Bubble…It’s the Dependency

This is what CNBC still doesn’t get, even as they start waking up:

The real danger isn’t that asset bubbles exist. It’s that the economy can’t function without them.

We’re addicted to gains. We’ve replaced productivity with paper wealth. And we’ve trained an entire generation to believe they’re financially secure...as long as the market goes up.

When that illusion breaks, the fallout won’t just be financial...it will be political, social, and existential.

But if you see it coming, and prepare accordingly, this “fatal flaw” becomes your greatest advantage.

If you’re lying awake at night wondering what’s real anymore...if your 401(k), your home equity, or even your job feels like it’s built on sand...you’re not alone.

Most investors and students of markets are desperate for answers, but they’re looking in the wrong places.

That’s why George Gammon built the Rebel Capitalist News Desk…to cut through the noise, decode the chaos, and help you see what’s coming before it hits.

Every Friday, George breaks down the week’s biggest market shifts, live, in plain English. You’ll not only hear what’s really happening…you’ll get to ask George your own questions, the ones keeping you up at night:

Is this rally real or just another trap?

Should I hold my cash or deploy it?

What happens if the Fed loses control?

Don’t face this alone. Join thousands of liberty-minded investors who refuse to be blindsided again.

👉 Upgrade today to the Rebel Capitalist News Desk…and start understanding the economy like your future depends on it. Because it does.