The Illusion of Housing Strength

How Builders Are Faking a Bull Market With Massive Price Cuts

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | September 25, 2025

“It’s like selling $20 bills for $10 and celebrating how fast they move.”

If you saw the headlines this week, you might think we’re in the middle of a housing boom.

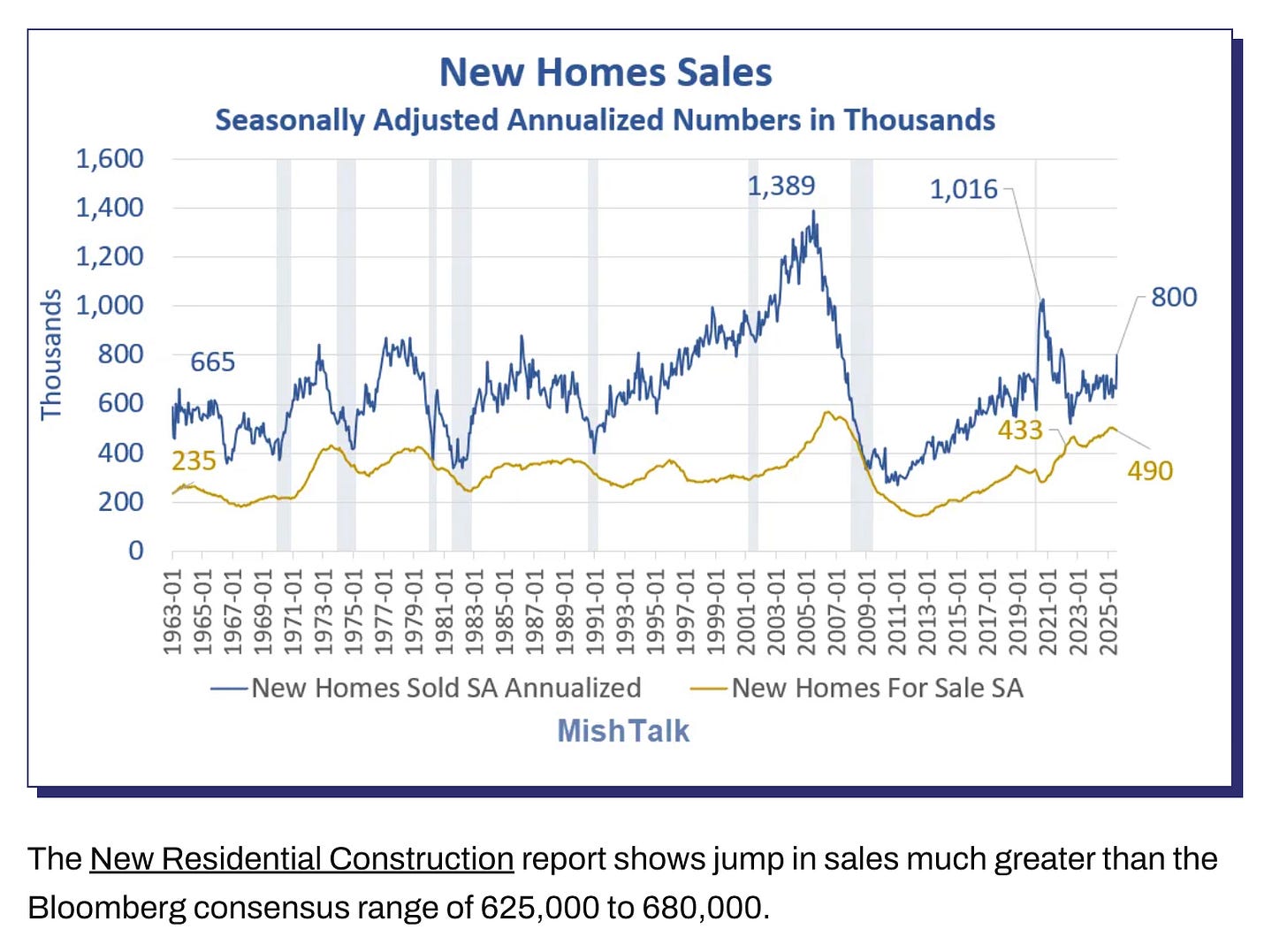

New home sales exploded to an annualized pace of 800,000…the highest number since January 2022. Wall Street cheered.

Housing stocks like LEN bounced. And CNBC’s talking heads lit up with “soft landing” optimism.

But here’s what they missed…and what the mainstream media will never tell you: The housing market isn’t strong. It’s desperate.

Behind those flashy sales numbers is a storm of collapsing margins, unprecedented builder incentives, and price cuts so steep they border on panic.

Builders aren’t thriving…they’re liquidating. And the worst part? The pain hasn’t even hit the comps yet.

The headlines may dazzle, but what lies underneath is desperation, not strength.

The real story isn’t about booming demand…it’s about builders torching their margins to keep the illusion alive.

And if this is what “optimism” looks like, imagine what the downturn will reveal.

Let’s dig in.

LEN’s 49% Earnings Collapse: The First Domino

Start with Lennar (LEN), one of the largest homebuilders in the U.S. They just reported a 49% drop in earnings per share year-over-year.

Not revenue…earnings.

Let that sink in. Nearly half of their profit gone in a single quarter.

Yet the stock rallied the next day. Why?

Because investors…and algos…only saw one thing: the 800,000 new home sales print.

Expectations were for just 649,000. That’s a monster beat.

But if you stopped there, you’d miss the entire story.

One quarter doesn’t break a company…but it does shatter illusions.

If Lennar’s earnings are falling off a cliff while sales are “surging,” what happens when the rest of the industry reports?

This isn’t resilience…it’s the first crack in a dam that won’t hold.

The Fake Strength Beneath the Sales Surge

The 800,000 number sounds bullish. But as always, the truth is in the margins.

Builders only hit that number because they are:

Slashing prices by 20–30% in key markets.

Offering massive interest rate buy-downs.

Throwing in tens of thousands in incentives.

Accepting razor-thin or even negative margins.

It’s like selling $20 bills for $10 and celebrating how fast they move. Sure, sales went up…but at what cost?

Let’s break down the math using Lennar’s own website.

If volume is the only thing propping up the narrative, then the narrative is already broken. Because when profits evaporate, Wall Street can’t ignore the truth forever.

The only question left is: who’s next in line to confess?

Real World Examples: Price Cuts That Will Shock You

Their listings in Texas and Florida…markets that were booming just 18 months ago.

What you’ll find is nothing short of shocking:

$77,000 price cut on a $287,000 home (26% drop).

$97,000 price reduction on a $500,000 home (20% drop).

$151,000 cut in Florida on a mid-range home.

Dozens of listings with cuts of $30K–$100K.

And these aren’t stale listings from last year. These are active, unsold homes…and even after the cuts, many are still sitting.

This is the kind of aggressive discounting you see in the clearance aisle…not a healthy real estate market.

When homes are slashed like clearance jeans, the market has already shifted.

These aren’t isolated markdowns…they’re previews of the comps that will reset entire neighborhoods.

And once the comps change, the contagion spreads faster than anyone wants to admit.

Why the Used Market Will Crack Next

You might be thinking: “So what? That’s new homes. The used market is holding up.”

That’s true…for now.

But here’s how this plays out:

Builders slash prices to move inventory.

Those new home sales set comps in the neighborhood.

Appraisers and buyers begin to reference lower prices.

Used home sellers are forced to adjust.

The cycle feeds on itself.

Right now, there’s a bizarre inversion: new homes are cheaper than used ones in many markets. That’s completely unsustainable.

Eventually, used sellers…many of whom are still anchored to 2022 Zillow fantasies… will have no choice but to cut. The longer they wait, the worse it gets.

The illusion of stability in the resale market is hanging by a thread.

As soon as appraisers mark down values, the “Zillow millionaires” will be forced to capitulate.

That’s when the grinding bear market in real estate moves from theory to reality.

The Dirty Secret of Interest Rate Buy-Downs

Builders aren’t just slashing prices. They’re gaming the monthly payment via temporary interest rate buy-downs.

Let’s say a buyer can’t afford a 7% mortgage. No problem…the builder “buys down” the rate to 5% for two years. The buyer’s monthly payment fits their budget.

But after that? It resets to the real market rate.

This is just a sneaky version of an adjustable-rate mortgage.

It’s 2006 all over again.

Except this time, the banks aren’t doing it…the builders are.

And it creates two ticking time bombs:

Mass delinquencies in 2–3 years when rates reset.

A false sense of demand that will vanish overnight.

It’s a shell game. And it’s going to end badly.

These temporary fixes create permanent damage.

Just as adjustable-rate mortgages set the stage for 2008, today’s buy-downs are setting a trap for 2027.

And when the resets come due, the true demand will vanish like smoke.

Cost Structures Don’t Lie: Builders Are Selling at a Loss

Let’s run the numbers.

A basic 2,200 sq ft home, built at $200 per sq ft, costs $440,000 in materials and labor alone. Add in $50,000+ for land and another $50,000 for permitting, inspections, and bureaucratic red tape. That’s $540,000 total cost…before profit.

But LAR is listing similar homes for $424,000…after a $150,000 discount.

That’s a $100K+ loss per unit.

It’s hard to overstate how insane this is. No company does this unless they have to. This isn’t about clearing inventory…it’s about avoiding insolvency.

Why It’s Happening in Texas and Florida First…and Why It Will Spread

Right now, the epicenters of this collapse are:

Houston

Tampa

Orlando

Parts of Dallas and Austin

These are the very markets that saw the biggest run-ups in 2021–2022. And they’re the ones most saturated with new supply.

But here’s the thing: these aren’t weak labor markets. These aren’t “Rust Belt” cities.

So if it’s happening there, it can happen anywhere.

The pressure will spread…especially as comps reset, interest rate buy-downs expire, and the Fed holds rates higher for longer.

When the math stops working, survival becomes the only strategy.

The fact that builders are willing to book losses just to clear inventory tells you how dire their cash flow position really is.

The longer this continues, the more bankruptcies we’ll see.

The Coming Shift in Psychology

Most homeowners still think their property is worth what it was in 2022. They haven’t felt the shift in demand yet. But once the new comp data rolls in, that will change.

And when it does?

Sellers rush to list before prices fall further.

Inventory spikes.

Bidding wars vanish.

Prices fall — both nominally and in real terms.

This isn’t about timing a “crash.” Real estate doesn’t crash like stocks. But it grinds. It drips lower. And over 2–3 years, you wake up 30% down…especially after inflation.

That’s the real risk. And it’s already in motion.

The day sellers realize yesterday’s price is gone forever is the day panic sets in.

And when psychology breaks, the math doesn’t matter…markets cascade under their own weight.

That moment is closer than most homeowners dare to imagine.

Why the Headline Bulls Are Dead Wrong

The next time you hear a talking head cheer “800,000 new home sales,” ask this:

At what price?

If builders are cutting prices by 20–30% to hit those numbers, it’s not a sign of strength. It’s a sign of weakness. A bull market built on fire sales is not a real bull market.

This is the classic mistake of confusing volume with profit.

And when earnings collapse, as they just did for LAR, the market wakes up — eventually.

Bullish headlines don’t stop balance sheets from bleeding.

And once earnings season after earnings season tells the same story, even the most stubborn bulls are forced to face reality.

The clock is ticking…the disconnect can’t last.

The Most Bearish Thing Is the Bullish Headline

Every cycle has its illusion.

In 2006, it was “they’re not making any more land.”

In 2021, it was “this time it’s different.”

Today? It’s “homebuilders are back.”

But behind the curtain, the fundamentals are rotten:

Massive price cuts.

Builders selling at a loss.

Adjustable-rate incentives masking demand.

Used home prices totally disconnected from reality.

Construction cost inflation squeezing margins.

This isn’t a recovery. It’s a controlled demolition.

And the smart money is already heading for the exits.

Every cycle ends with people cheering the very thing that destroys them.

Today’s “strength” is tomorrow’s obituary.

And by the time the cheerleaders stop clapping, the smart money will already be gone.

Trade Ideas: Betting Against the Housing Mirage

1. Short Homebuilders (ITB, LAR): Earnings are collapsing, margins are gone, and the narrative is about to crack.

2. Short Regional Banks: Exposure to residential construction loans and second-lien HELOCs could come back to haunt them.

3. Long Gold: As housing weakens and the Fed pivots to defend the credit markets, real assets win.

The opportunities here aren’t in chasing a fake boom…they’re in positioning for the inevitable bust.

Housing isn’t recovering, it’s unraveling. And if you know where to look, the trades are lining up.

The mainstream will keep feeding you headlines. We’ll keep showing you the hidden truth behind them.

If you want to see where the next cracks form…and how to profit while everyone else is blindsided…join thousands of contrarian investors inside the Rebel Capitalist News Desk.

Subscribers get George Gammon’s weekly wrap-ups (Friday’s after market close), subscriber-only whiteboard videos, deep-dive trade ideas, and real-time macro insights you won’t find anywhere else.

The smart money is already preparing.

The only question is: will you be on the inside or still reading CNBC after the damage is done?

👉 Upgrade to Rebel Capitalist News Desk on Substack today

One happy superstition we cling to is that real property has permanent value.

I hear from a relative there that her house value cratered after the boom. It lost95% of value. In 1995 or so.

Still waiting, still waiting. Thirty years.

There is collateral damage here. Local communities dependent on property taxes to fund education. Lower housing prices at scale will reset their tax bases lower. They will need to cut costs, raise taxes or depend on states to fund at a higher level.