Used Car Crash

What CarMax’s Implosion Tells Us About the Economy’s Rotten Core

Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | September 26, 2025

If you want to know what’s really happening with the U.S. economy, don’t look at GDP. Don’t get distracted by Wall Street’s spin on initial claims. And definitely don’t let mainstream financial media gaslight you into thinking we’re headed for a soft landing.

Look at used cars.

Yes, used cars…the most under-appreciated, data-rich, real-time reflection of consumer health in America.

This week’s wreckage in the used car market tells you everything you need to know about the real state of the economy.

CarMax (KMX), the nation’s largest used car retailer, plunged 20% in a single day, following a disastrous earnings report.

That brings its total YTD drop to nearly 45%.

Meanwhile, subprime auto lender Tricolor filed for bankruptcy, confirming what many of us suspected: the foundation of consumer demand is rotting from the bottom up.

Let’s unpack what’s happening…and why this isn’t just about cars. It’s about debt, demand, immigration, inflation, and the collapsing American middle class.

CarMax Collapse: Not Just a Miss…A Meltdown

Start with the numbers.

Wall Street expected $1.15 in EPS. CarMax delivered $0.99.

Revenue? Expected to top $7 billion.

Actual: $6.6 billion.

That’s a big miss. But more importantly, it wasn’t just a one-time event or a seasonal fluke.

According to CEO Bill Nash:

“Each month was down year-over-year, and each month got a little weaker throughout the quarter.”

In other words, this is an accelerating downtrend. Sales are deteriorating. Pricing power is collapsing. And foot traffic is drying up.

This isn’t just about inflation or rates. It’s about demand destruction.

CarMax’s numbers weren’t just weak…they were a signal that U.S. consumers are already tapped out.

But what’s scarier is that even the temporary props holding demand together are starting to vanish.

Which brings us to the next piece of the puzzle: tariffs and the dangerous illusion of “pulled-forward” demand.

Pulling Demand Forward: The Tariff Effect

One reason for the Q2 demand blip? Tariff fears.

Consumers and dealers tried to front-run expected tariffs by buying earlier than usual. This “pull forward” creates a demand vacuum later.

It’s the same playbook we’ve seen over and over:

Buy now to beat price hikes.

Drain future demand into the present.

Suffer the hangover when the rush ends.

Now the hangover is here…and it’s brutal.

The hangover from tariff-driven demand isn’t confined to cars.

It’s the same distortion now creeping across everything from electronics to housing.

And if one retailer like CarMax can implode on these shifts, what happens when the weakest link in the credit chain snaps?

That’s exactly what we saw this week with Tricolor.

Tricolor Goes Bust: The Subprime Canary in the Coal Mine

CarMax isn’t the only car company in trouble. Subprime lender Tricolor filed for bankruptcy just days ago.

Their model? High-risk loans to low-credit borrowers…often immigrants…with higher rates, shorter terms, and loose standards.

So what happened?

Two theories:

The Immigration Argument: Tricolor was lending to migrants who have since left the country, abandoning their cars and loans.

The Subprime Argument: It wasn’t just immigrants…it was everyone in the lower tiers of credit. And they’ve stopped paying.

Which one is true?

Probably both. But even if it’s 70/30, the key insight remains: the consumer is cracking…especially the poor and working class.

And when the base of the pyramid collapses, it won’t take long for the rest to follow.

The bankruptcy of a niche lender might sound small, but history shows subprime cracks rarely stay contained.

In 2007 it was mortgage lenders.

In 2025, it could be autos.

The real warning isn’t about Tricolor…it’s about what happens when the broader credit pyramid starts wobbling. And to see how deep this goes, we need to zoom out to the used car market itself.

The Broader Picture: Why Used Cars Matter

Used car sales are a leading indicator for three reasons:

Financing Sensitivity: Most buyers rely on credit. Used car sales drop when borrowing gets harder or more expensive.

Discretionary Demand: People can delay or downsize purchases when money’s tight.

Collateral Valuation: Used car prices are tied to subprime loans and securitized debt. Falling prices mean rising defaults.

In short, used cars sit at the intersection of debt, inflation, and real demand.

If the used car market is collapsing, it’s a signal the rest of the consumer economy isn’t far behind.

Used cars sit right at the fault line between consumer demand, credit fragility, and real asset values.

When that market buckles, it doesn’t just take down dealerships…it reverberates across banks, bond markets, and households.

So why does the “official data” still scream growth while the streets tell a different story?

A Conflicting Message: GDP Up, CarMax Down?

Here’s where it gets weird.

This same week, we saw the Q2 GDP revised upward to 3.8%, initial claims drop to 218K, and durable goods orders smash expectations at +2.9%.

If you just looked at that data, you’d think we’re in a boom.

But then CarMax implodes. Tricolor goes bust. Bitcoin tanks. MicroStrategy drops 9%. So what gives?

The answer is simple: the macro data is backward-looking…and probably wrong.

This is the paradox: glowing GDP headlines on one hand, collapsing consumer signals on the other.

One of them is lying…and it isn’t the used car lot. But markets don’t wait for revisions; they move in real time.

Which is why interest rates just spiked (despite the Federal Reserve (Fed) recently dropping its benchmark interest rate by 0.25 percentage points to a new target range of 4.0% to 4.25%), and the fallout is already being felt across risk assets.

Interest Rates Surge on Misleading Data

The market took the GDP revision and initial claims as bullish…for growth and inflation. So rates surged. The 10-year yield jumped. The curve flattened. And the dollar spiked.

But this is a classic case of reading the scoreboard, not watching the game.

Because while the data said “growth,” the markets said otherwise:

Bitcoin crashed.

MicroStrategy cratered.

Risk assets rolled over.

CarMax imploded.

The used car market is telling you where we’re headed. And it’s not growth…it’s contraction.

Every tick higher in yields tightens the vice on consumers, corporates, and sovereign debt alike.

And yet, markets reflexively push the dollar higher as if this can go on forever.

But currencies are confidence games…and when confidence breaks, the unwind is brutal.

The dollar’s strength today hides its fragility tomorrow.

The Dollar Surges…But For How Long?

With yields rising, the dollar surged to nearly 98.5 on the DXY.

This isn’t necessarily a vote of confidence in the U.S. economy. It’s a bet on interest rate differentials.

As the Fed is seen staying higher for longer…and the ECB looks weaker…capital flows into dollars.

But that only works in the short term.

Over the long run, the dollar depends on confidence, not carry. And confidence is fragile when your consumer economy is cracking from the bottom up.

The dollar may look unstoppable in the short run, but history says otherwise.

Once capital realizes rate differentials can’t paper over structural weakness, flows reverse violently.

That reversal often sparks rotation into alternative stores of value. Which makes Bitcoin’s recent price action all the more puzzling.

Bitcoin Takes a Beating…Despite Institutional Tailwinds

Bitcoin bulls are scratching their heads.

Institutional demand is rising.

Strategic reserves are in play.

MicroStrategy is buying billions.

Treasury usage narratives are gaining steam.

And yet, price is down. Support at $107–108 is being tested. If it breaks, the chart looks ugly.

Why?

Because rates matter. I

n the short run, interest rates are a massive headwind for non-yielding assets like Bitcoin.

And despite all the tailwinds, the market is telling us something sobering: There’s still too much selling pressure.

Despite every bullish narrative in the book, Bitcoin just can’t get traction under higher rates.

That disconnect should terrify bulls because it means the market is prioritizing liquidity over story.

And when even Bitcoin looks fragile, leveraged proxies like MicroStrategy become the easy target.

The Spread Trade: Long Bitcoin, Short MicroStrategy

One interesting trade idea surfaced in this week’s breakdown: long Bitcoin, short MicroStrategy.

Why?

Because MSTR is essentially a leveraged bet on Bitcoin. But when volatility spikes, it gets punished more than the asset it tracks.

This makes it a prime candidate for a spread trade:

Long BTC: Store of value, outside the system.

Short MSTR: Overexposed, leveraged, and vulnerable.

It’s a barbell strategy that lets you benefit if Bitcoin stabilizes but MSTR remains under pressure.

Not investment advice, but worth watching.

It’s a pure expression of fragility versus resilience: BTC as a neutral monetary asset, MSTR as a leveraged corporate bet.

One can survive the volatility, the other might not.

But this isn’t just about trading tactics…it’s about reading the macro script hidden in plain sight.

And right now, nothing speaks louder than collapsing used car prices.

Used Cars Don’t Lie

The economy is sending mixed signals.

GDP up, but consumer credit defaults rising.

Claims down, but used car demand collapsing.

Bitcoin tailwinds, but price action bearish.

In times like this, ignore the headlines. Watch the real economy…and the charts that reflect it.

Used cars don’t lie.

CarMax is down 45% this year. Subprime lenders are going bust. And pricing power is disappearing in front of our eyes.

That’s your signal. Not what Powell says. Not what CNBC spins. And not what a revised GDP stat says from three months ago.

The headlines can spin, the Fed can posture, and Wall Street can cheer GDP revisions.

But the repo lot doesn’t lie.

The cracks in consumer credit are widening…and they always spread.

The only question left is how fast contagion moves from the car lot to the entire economy.

That’s where positioning now matters most.

Trade Ideas: Navigating the Used Car Crash

1. Short Auto Retailers (KMX, CVNA): CarMax’s collapse is just the beginning. Carvana, AutoNation, Lithia — all vulnerable.

2. Long Used Car Price Volatility (CALL Options on KMX): Volatility premiums may be mispriced after the selloff. Bounce trades possible.

3. Short Subprime Auto ABS (Asset Backed Securities): Exposure to default-prone consumers is rising. Look for synthetic trades or ETFs with subprime exposure.

4. Long U.S. Dollar ($UUP) — Short-Term Only: Rate differentials are driving a dollar rally, but don’t expect it to last.

5. Long Bitcoin — Short MicroStrategy: The divergence trade. BTC may find support, MSTR remains overleveraged.

Whether you lean bearish on retailers, play volatility, or hedge through spreads, the key is recognizing that this market isn’t healthy…it’s desperate.

The signals are already here.

The only investors who’ll be ready for the next leg down are the ones connecting dots the mainstream refuses to see.

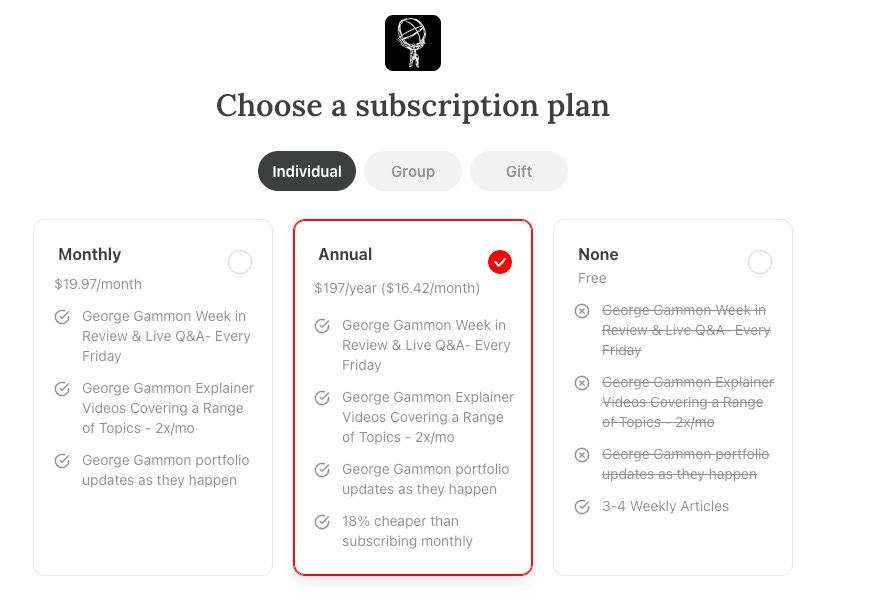

If this breakdown helped you cut through the noise, don’t stop here.

The real deep-dive comes this weekend in George Gammon’s Weekly Wrap-Up — exclusively for Rebel Capitalist News Desk paid members.

Inside, George will connect these cracks in autos to the bigger macro chessboard: the Fed’s next move, the dollar’s breaking point, and the trades asymmetric investors are already lining up.

Thousands of liberty-minded readers are upgrading to paid so they don’t miss it. Are you?

👉 Upgrade now to unlock the weekend wrap-up, subscriber-only whiteboard videos, and in-depth trade ideas you won’t find anywhere else.

♥️♥️😁 Back before the trolls spoiled the fun we women used to have being looked at!

(Shhhhhhh…. don’t tell anybody, but I still have no problem if a guy looks at me 😉)

Show the graphs before other crashes to compare if it’s supposed to be an indicator. Used goods have seemed overpriced for a while. Maybe people are buying new cars even. Too little information!