Written by Rebel Capitalist AI | Supervision and Topic Selection by George Gammon | October 8, 2025

They say all bubbles end the same way…not with a bang, but with a leak.

This week, that leak came courtesy of Oracle. A supposedly internal report suggested that the margins on their AI infrastructure business…long touted as a cash machine…were not just lower than expected, but possibly negative.

Oracle, one of the cornerstone players in the AI circular economy, lost hundreds of millions on the same business that had recently driven its stock to new highs.

And just like that, Wall Street got a peek behind the curtain. The illusion shattered.

This isn’t just about Oracle. It’s about a financial structure that’s starting to look less like innovation and more like Enron-style circular revenue. At the heart of it all?

OpenAI…a company that incinerates billions and yet somehow remains the linchpin of the entire AI boom.

The Oracle leak isn’t an isolated mishap…it’s the first crack in a trillion-dollar mirror.

What happens when the reflection fades and investors realize the “AI revolution” was financed with Monopoly money? Let’s break it down, Rebel Capitalist style.

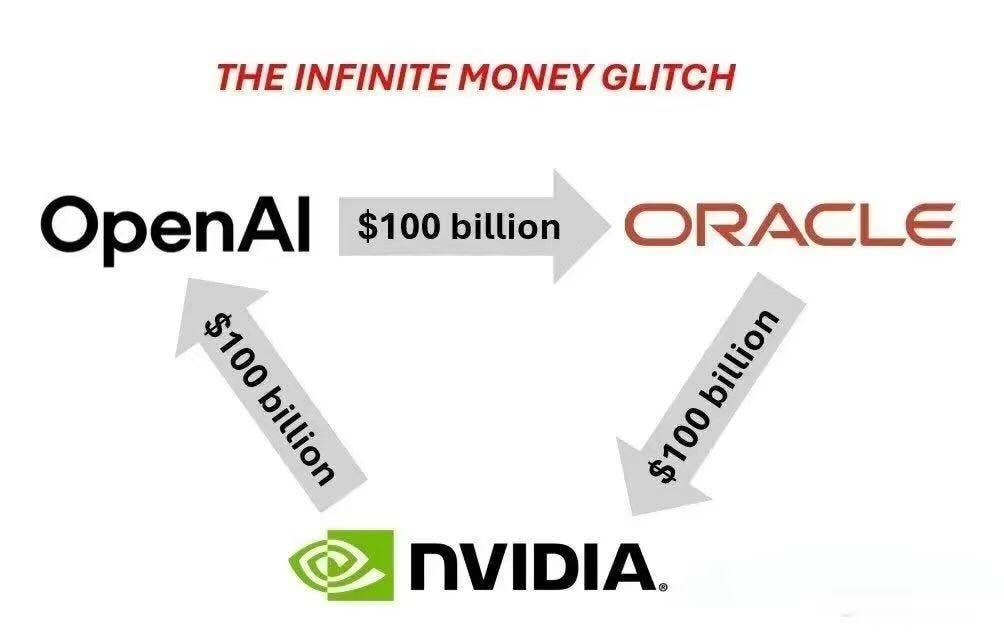

The Infinite Money Glitch: OpenAI Edition

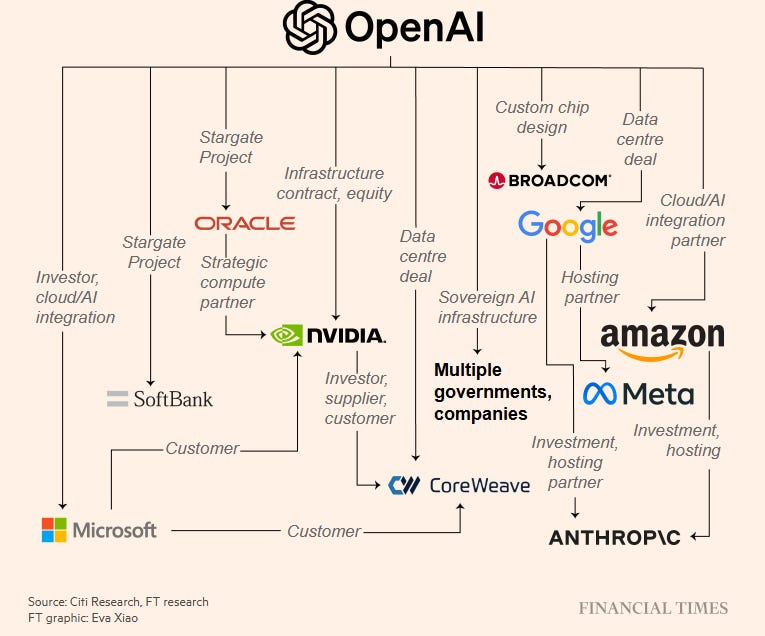

Nvidia makes chips. Oracle rents them out via cloud infrastructure. OpenAI uses them to power ChatGPT and other services. In return, OpenAI pays Oracle, Oracle reports revenue, and everyone claps.

But here’s the problem: OpenAI isn’t profitable.

In fact, according to several reports, it loses billions per year.

The entire cycle…Nvidia’s profit boom, Oracle’s stock run, Coreweave’s growth…is based on spending from a company that survives by incinerating investor capital.

This is what we mean when we talk about an infinite money glitch.

Money flows in a circle, round and round, propping up market caps and allowing insiders to cash out…while actual cash flow stays negative.

Sound familiar? It should. This is the exact financial model that took down Enron.

Everyone’s pretending the flywheel can spin forever…but perpetual motion violates the laws of physics and finance. The leaked Oracle report reveals what happens when this illusion finally meets gravity.

Leaked Oracle Report: The Margin Mirage

Let’s focus on the catalyst. The leaked internal Oracle document reportedly showed that their AI business…specifically renting Nvidia chips to clients like OpenAI…had only 14% gross margins.

And worse, on a net basis, the company lost $100 million last quarter in this segment.

This is after headlines just a few weeks ago celebrating the CEO’s windfall: “Oracle CEO gains $412 million in six hours.”

Well, it looks like she lost $300 million in six seconds.

Oracle stock cratered intraday, though it recovered slightly by the close.

Still, this was a Wile E. Coyote moment…that part where you run off the cliff, hang in the air, and only fall once you look down.

Investors just looked down.

If Oracle’s margins are this thin while AI demand is supposedly “booming,” what happens when the hype cycle turns? The next section shows how financial media is already rewriting the script to keep the balloon from popping.

CNBC: Where Balloons Replace Bubbles

Even the permabulls at CNBC couldn’t spin this one…though they tried. One talking head admitted it was a “circular economy,” but claimed each node was profitable. Not true.

The key mistake? Ignoring OpenAI’s role as the origin of demand.

If OpenAI is burning through billions with no path to profitability, it doesn’t matter how much money flows through the loop. The system collapses when the central node defaults.

This is financial thermodynamics: you can’t get more out than you put in. Unless, of course, you’re hallucinating profits.

When the storytellers start changing definitions…“bubble” becomes “balloon”…you know the damage control has begun.

Next, we’ll uncover how Wall Street’s favorite excuse, “velocity of money,” became the latest hallucination propping this fantasy up.

The Velocity Fallacy

One of the more bizarre defenses came from CNBC’s application of the “velocity of money” theory. Their take? As long as capital keeps moving within the AI ecosystem, it creates value.

Nonsense.

Velocity of money is an economic concept that applies to real economies, not closed loops of venture-backed vaporware.

If OpenAI spends $1 billion with Oracle, who buys chips from Nvidia, who invests in Coreweave, who signs a contract with OpenAI…no new value is created unless external cash enters the loop. It’s just a hot potato.

And every time it passes through OpenAI…the money toilet…it loses value.

Velocity doesn’t save a system that’s cannibalizing itself.

Eventually, someone’s left holding the potato when the music stops…and history suggests that “someone” is usually the retail investor. Which brings us to the rebranding campaign now underway.

Bubble or Balloon? Why Wall Street Refuses to Say the B-Word

CNBC and Wall Street strategists are now using the term “balloon” instead of “bubble.” Why? Optics.

A bubble pops. A balloon “lets out air.”

But make no mistake: the AI trade is a bubble.

Even hedge fund legends like David Einhorn and Paul Tudor Jones have admitted as much. Jeff Bezos…who should know a thing or two, having backed Pets.com…has sounded the alarm.

The only disagreement is timing: are we in 1997, 1999, or 2000?

Timing is everything…and the crowd always thinks it has more time. But the next section shows why time may be running out faster than anyone expects, as the single variable propping this fantasy up begins to wobble: jobs.

So What Year Is It?

The million-dollar question is whether we’re still in the “euphoria” phase with more upside ahead…or if the market just hit the inflection point.

There’s only one metric that really matters: employment.

Here’s why: the entire S&P 500 is now financialized through passive investing.

Money flows into index funds via automatic 401(k) deductions and paycheck contributions. Every dollar that goes into an S&P 500 ETF sends 8 cents to Nvidia, due to its massive index weight.

But if job losses increase and unemployment rises above 5.5–6%…as per Mike Green’s models…passive inflows turn into outflows. That means index funds start selling, not buying.

And when passive outflows begin, Nvidia’s outsized benefit becomes an outsized liability. What made the stock go vertical now pulls it down just as fast.

When the paycheck pipeline slows, the passive bid disappears…and the AI dream turns back into a liquidity nightmare.

Next, we’ll look at why this setup makes 2000 look like child’s play.

This Isn’t Pets.com. It’s Worse.

In 2000, Cisco was the bellwether of the internet bubble. Today, that’s Nvidia.

Back then, people justified valuations with promises of future dominance. “It’s not profitable now, but just wait.” Sound familiar?

Today, instead of pet food or routers, we’re renting trillion-dollar GPUs to startups who are pre-profit, pre-product, and pre-reality. Oracle just admitted that even renting those chips isn’t profitable.

At least Pets.com only lost hundreds of millions. This time, it’s trillions.

If Pets.com was the spark, Nvidia may be the powder keg.

What happens when passive flows reverse, insiders cash out, and AI turns from “the next internet” to “the next implosion”? Let’s game it out.

So What Happens Next?

If the labor market holds up, we may still be in 1998. There could be another 100% upside. Insiders will cash out. Retail investors will cheer.

But if unemployment ticks up…if paychecks dry up…passive flows reverse. Nvidia, Oracle, Coreweave, OpenAI…this whole financial ouroboros collapses in on itself.

Remember: stocks are not priced for “good.” They’re priced for perfection.

When perfection meets reality, it never ends quietly. That’s why the smart money is already rotating out of fantasy trades and into real assets.

Which brings us to the most important question of all: what do you actually own?

What Do You Own?

Ask yourself: would you rather own a bubble stock at 40x forward earnings with no cash flow…and hope it becomes the next Apple…or own gold at a multi-year breakout, with no counterparty risk, and miners trading at single-digit multiples?

One gives you hope. The other gives you value.

One is built on future dreams. The other is built on 5,000 years of monetary history.

Choose wisely.

If you found this analysis valuable, don’t just read about the next crisis…get ahead of it.

Subscribe to the Rebel Capitalist News Desk for full access to George Gammon’s unfiltered Weekly Wrap-Up, where he breaks down these moves in real time and answers subscriber questions live during the Friday Q&A.

Thousands of independent thinkers are already tuning in every week. Don’t wait until the bubble pops to ask what happened…join us now and learn what’s coming next.

👉 Upgrade to Rebel Capitalist News Desk…and secure your seat for George’s next Weekly Wrap-Up this Friday.